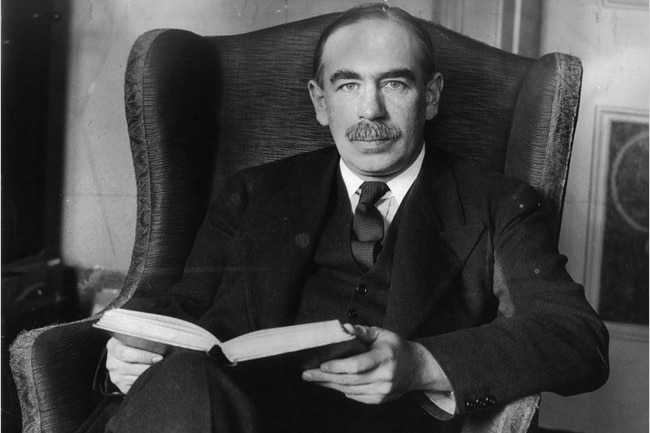

John Maynard Keynes theory on Portfolio Concentration, a Depression-era economist and accomplishing investor, when challenged about an overly large buy of one company’s shares once quipped in a letter:

“One good share is safer than ten bad ones.” – JM Keynes, January 1942

Regarding diversification, Keynes also had occasion to remark: “To carry one’s eggs in a great number of baskets, without having time or opportunity to discover how many [baskets] have holes in the bottom, is the surest way of increasing risk and loss.”

To illustrate John Maynard Keynes’ Theory, suppose an investor owns only two things during a decade. One grows to 8x, and the other goes bankrupt to zero. Overall, the return is 4x, or 15% each year.

Next, let’s consider a “diversified” portfolio with ten items. Two each grow to 8x, one crashes to zero, and the remaining seven each double. Aggregate decade return? Three times, or 12% yearly – even though there were TWO huge successes and only one mistake!

Would it not make more sense to concentrate on one or two successes to offset the occasional mistake than to “diversify” away great gains with run-of-the-mill properties?

Warren Buffet, whose Berkshire Hathaway assets contained only a few holdings in the late ’80s [Washington Post, GEICO, ABC-Cap Cities, Coke], has certainly thought so.

“Diversification” can also foster a false sense of protection, as Keynes’ second quote implies. If one buys over-priced securities, it does not matter how many ones get owned. Diversification, per-se, does not and cannot guard against this over-payment risk – a gaping “hole” in any investment basket. Furthermore, it too often waters down the aim of investing: owning superior businesses at attractive prices.

Written by: Brad Miller