Pillar I: Compelling Security (CS):

Blockchain technology is an integral part of how cryptocurrencies, including Bitcoin, work. However, it is esoteric. This makes it difficult to understand for the layman. In their most distilled form, blockchains consist of chronological ledgers that record every transaction. In these ledgers, records are stored in the form of cryptographically-verifiable chunks referred to as blocks. These blocks are, thereafter, chained together to form the blockchain.

In addition, blockchain technology prevents individuals and groups from making transactions of assets they no longer have. This ensures that blockchain-backed assets cannot be spent more than once. This is another one of the many ways blockchain provides compelling security. Furthermore, blockchain networks operate on decentralised servers with data distributed across thousands or millions of computers. This means that assets could be exchanged using multiple hosts, hence hackers get rendered unable to target a single point of entry or a grid-network of servers.

Still, whereas blockchain is yet to go mainstream and Bitcoin hasn’t been adopted all over the globe, the concept of blockchain technology is proving successful especially with regards to improving security in a variety of fields, such as finance and e-voting. The better security it eschews is also likely to impact the day-to-day life of the average person in the near future.

Blockchain technology goes a long way in speeding up the settlement of transactions, the reduction of costs, and the provision of better security in industries where processes are frequently delayed because of the need for third party verification – such as transportation, energy and banking. Blockchain technology also reduces the level of risk that transactions will be denied.

Through the removal of the need for middlemen, blockchain also enhances the security of transactions and user experience. This is because the greater the number of parties involved in any given transaction, the greater the risk that the transaction could become time-consuming and compromised. Within a blockchain network, it is possible for transactions to transpire between two parties directly. As a result, this ensures that there are fewer chances of security failure at any of the hand-off points.

Therefore, blockchain simplifies transactions and makes it easier, cheaper and more secure for people to engage with each other. In the corporate world, record-keeping will be simplified and secured by reducing the need for such validations as third-party signatories and notaries. As a direct result, corporations producing assets in digital format will be able to track the use of such assets with greater precision, be able to generate licensing revenues and royalties and secure themselves from property loss.

Over and above everything else, blockchain has already started fuelling technological services and developments. The blockchain mechanism that provided such compelling security for the Bitcoin network now holds real promise for other sectors. This compelling security is also going to affect transport, banking/finance, corporations, insurance, healthcare, payments, legal/compliance, cyber-security, digital identities, governments, energy, and the Internet of Things, as can be seen in this article.

The Effects of Blockchain Technology’s Compelling Security (CS) on Various Sectors

Blockchain is typically associated with transactions involving digital currencies, which can be easily exchanged without the need for intermediaries like clearing houses and banks. As a result, all Bitcoin transactions are considered highly secure and happen almost instantaneously.

However, there are many other applications of blockchain. This means that the compelling security that blockchain provides will be applied to a wide variety of other sectors. For example, professional photographers will be able to use blockchain to verify the authenticity of every copyrighted photo on their portfolio. Therefore, copies of the photographs that lack the verified technology will be pegged as fraudulent and stolen/pirated. The same also goes for contracts, deeds, titles, and other documents that are often exchanged between parties within a trust network.

Similarly, blockchain can be used to create verifiable digital records of payments and used by content creators. The compelling security this technology provides will expedite transactions as well as ensure that every party has a right to use copyrighted material before they can access it.

Whatever the case, blockchain can be private or public, with the rules involving transactions being set by all of the parties engaged. Consider the following ways that this compelling security with blockchain technology could affect the industries and sectors listed below:

Transport/Logistics

Better security with blockchain will provide special advantages to public cloud B2B solutions when it comes to the tracking and execution of transportation. These solutions currently offer large pre-existing networks of carriers and shippers that are already connected to a platform. This means that key supply chain partners will have an easier time providing visibility to each other. These solutions, when affected by the compelling security that blockchain comes with, will offer complete records of transactions within the marketplace. These records will greatly reduce the she said, he said type of arguments that normally affect supply chain contracts.

At the time of writing, companies invest billions of dollars to training their employees and protect their systems. However, several surveys show that cyber-security is on the upward rise. Therefore, supply chain executives are worried and need to build supply chain resilience capabilities that are more robust.

This is why it is interesting to note how the compelling security that blockchain technology provides will be instrumental in the creation of more robust visibility and tendering that all parties involved in the transport industry could wholly trust. This technology could also be used to build secure and robust visibility and executive in the transport sector.

Blockchain will also go a long way in creating a widely distributed public ledger for transactions within the transportation industry. As such, anyone within the same network will be able to download copies of these ledgers. The technology will also protect the identities of the parties using clever cryptography, and the system will be entirely translucent.

Since blockchain provides a computing environment that is completely distributed, the data resides everywhere. When applied to transportation, it follows that there will be no single access point which, if and when breached, would allow the entire system to be corrupted and exploited.

Better security with blockchain also means that it will be possible for the ledger to track the shipment of products from the seller to the buyer. Since transport tendering happens to be analogous to the financial settlement process, it means that one of the best places to start exploring the application of better security with blockchain is in the supply chain.

Further Reading on Blockchain Technology in the Transport Industry:

Blockchain for Securing Sustainable Transport Contracts and Supply Chain Transparency by Lund University

Things happening in, around, and to freight transportation by Chalmers University

Minutes of the Digital Transport and Logistics Forum (DTLF) 3rd Plenary session (Brussels, 16 March 2016) by The European Union

Future of Transport Summit (Post-Summit Report, May 2016) by The New South Wales Government (NSW)

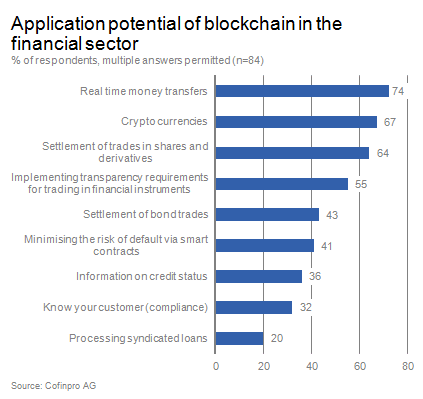

Finance (FinTech)

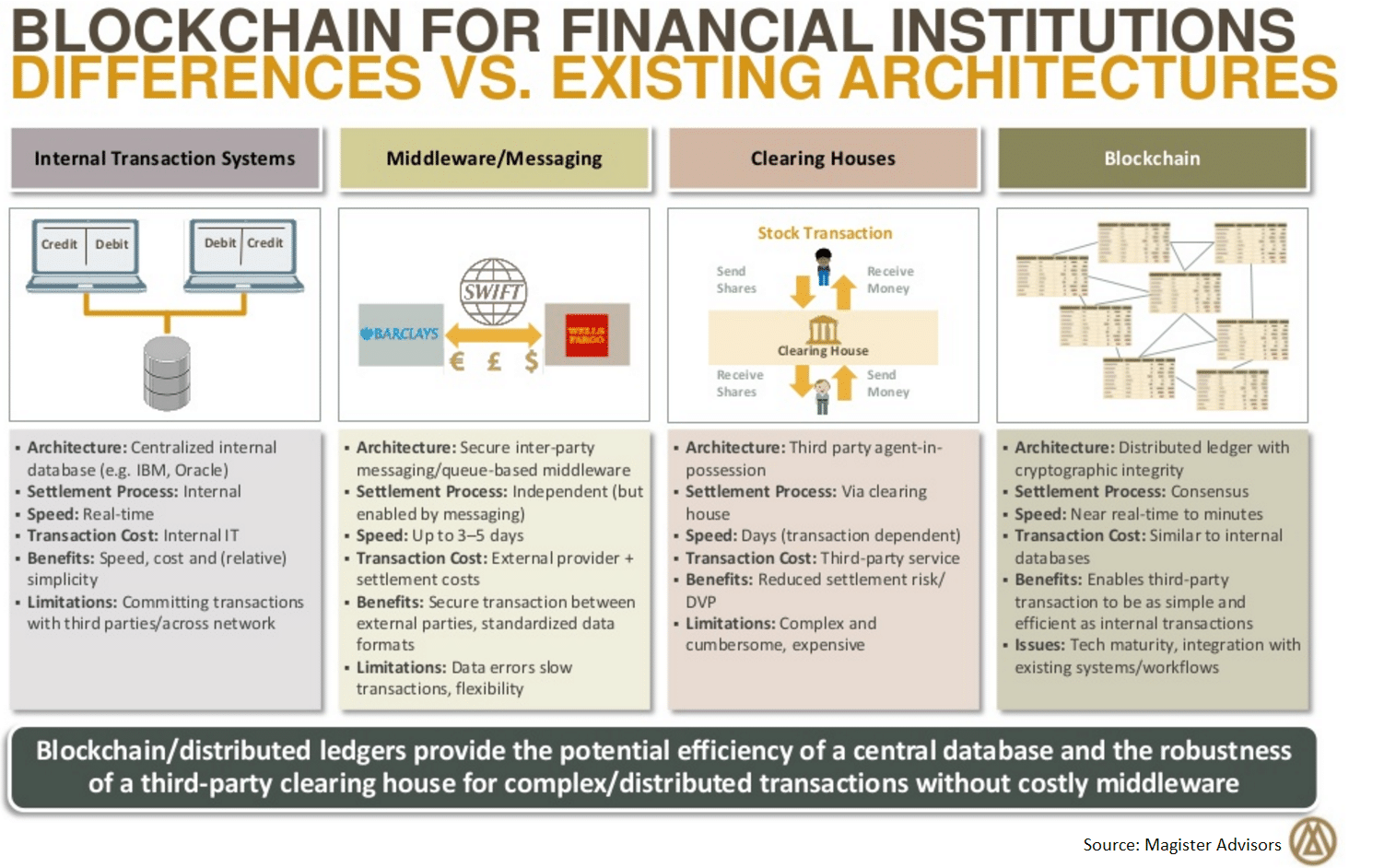

Banking technology is, often rather than not, rather conservative. As such, most systems that handle accounts and transactions were built in the 50s using such archaic languages as COBOL and run on old mainframe systems. Most of these programs are yet to be discarded chiefly because of the astronomical costs of modernising them. Similarly, banking and finance are inherently resistant to technological change. As a result, it is easy to assume that whenever large financial institutions experiment with new technology, it is often for the long haul.

At the time of writing, forty of the largest banks in the world (including Goldman Sachs and Barclays) have recognised the compelling security that blockchain eschews along with the other pillars. As such, they have started experimenting with blockchain technology.

Blockchain technology is inherently secure. Every transaction made through blockchain is recorded using the distributed ledger technology discussed above, these records are thereafter distributed to every node within the network. This means that records cannot be tampered with or modified, thereby mitigating risks of fraud.

Although better security with blockchain will mostly affect low-level transactions, the greatest area of application might be in the smart contracts area. Security means that smart contracts will be easy to adopt for purposes of automating huge segments of the banking process.

The fundamental idea is that smart contracts work with pieces of code that can automatically check that the terms of any given contract have been met by the involved third party. Once this happens, the code would record it against the blockchain ledger and close the contract.

By so doing, blockchain will solve the numerous security problems and concerns within the banking and financial worlds. Banks that digitise their assets within the blockchain will be able to take advantage of the cryptography that blockchain uses to secure and identify ownership of these assets. Over and above everything, nobody will be able to copy or steal the digital asset unless they have the private key or secret code that unlocks the cryptographic protection placed on the asset.

Therefore, better security with blockchain will be applied to a wide variety of transactions, such as those within the financial markets. When people need to perform trades or move digital assets around several times in any given day, it will no longer be as risky as it is at the time of writing.

Further Reading on Blockchain Technology in the Banking/Finance Industry:

Blockchain applications in banking by Deloitte

Blockchain in retail and consumer banking by PwC

Blockchain services for banking & financial services by Capgemini

Interdependence of emerging technology on next-generation banking by KPMG

The future of retail banking and the case for core transformation by Temenos

Payments

When people make payments using fiat currencies, there are always fixed minimum costs for each transaction. As a result, small payments for services or goods are typically rendered to be too expensive and risky. For instance, sending small amounts of money overseas is not feasible due to the minimum cost of transferring and exchanging currency. However, using blockchain technology means that it will be able to send small or large payments over the internet because they will not entail the traditional security risks and fees that are added by money transfer systems in the market.

The ability to transfer monies globally through money transfer systems built on blockchain will enjoy better security and allow international payments in real time, at very low costs, and in safe ways. It will also cut out the risk that is associated with converting currency after withdrawing money sent around the globe.

When considering better security with blockchain, most people think about the financial sector in general and money in particular. Bitcoin has enabled young women in countries like Afghanistan (where the law prohibits them from doing certain things) to sell their video production and social media marketing skills as well as write blogs. In exchange for their work, these women are paid in Bitcoin which is safe and secure from the eyes of overseers in restrictive governments. Bank wires often require authorisation, and PayPal isn’t supported in these countries. Therefore, the most secure way for these women to receive their payments is through blockchain.

Over and above everything else, blockchain has already worked well in providing cryptocurrencies like Bitcoin with the verifiable ledger of transactions needed. This ledger, when paired with the security provided by the distributed network created by blockchain, goes a long way in enabling people cut out the banks and middlemen that were traditionally involved (and increased security risks). People will, therefore, be able to take full control of their digital money and perform various transactions and make payments knowing that they and their monies are secure.

Further Reading on Blockchain Technology in the Payments Industry:

Innovation in payments: the future is fintech by BNY Mellon

Distributed ledger technology in payments, clearing, and settlement by The Federal Reserve

The future of payments by Payments UK

Distributed consensus ledgers for payments by Accenture

Mobile money & payments: technology trends by Massachusetts Institute of Technology (MIT)

Technical innovation in payments by PNC

Organisations

Organisations also stand to gain from blockchain technology. They particularly have tons of flexibility with regards to the deployment of blockchain within their networks. To deploy blockchain within systems such as those employed in the corporation, one would need to go another way that is altogether different from the way that Bitcoin uses blockchain technology. The general idea is that companies will be able to put anything they want to store within the blockchain.

Better security will also make it possible to divide marketing. Companies, say, looking to buy a million widgets will be able to place their orders over the blockchain. The widget factories, on the other hand, will need to invest in new machinery and plans to make the widgets. After the order has been completed, the contracts will start executing automatically over a secure network.

This is possible especially if the money for paying for the widgets could be locked away using blockchain technology in some digital equivalent or in Bitcoin. Some other third party will need to validate that the contract has been duly fulfilled. After it has been found to be fulfilled, the money would securely leave the blockchain.

Another of the intriguing possibilities that blockchain security comes with is in the installation of new access controls and risk-based authorisation. Corporations can use these to create dynamic systems that grant access depending on how trustworthy the user requesting admission/access is, as well as based on the sensitivity of the data/information that is under protection.

A good example of the effects of better security with blockchain with corporations is Project Abacus. This initiative by Google and Advanced Technology is developing improved machine learning for purposes of authenticating users based on different assessments of their past behaviour. Trust scoring will prove useful in the design of protections for information – depending on how sensitive it is, of course. For instance, company apps will require high trust scores, more so than access to generalised news websites and blogs. Companies will also be able to secure consumer privacy thanks to the technology under discussion.

Further Reading on Blockchain Technology in the Area of Corporations:

Distributed collaborative organisations by Harvard Law School et al.

9 startup ideas from Duke University’s cryptoventures course by Duke University

Science + Government + Business = Triangle of Innovation by IBM

Pervasive decentralisation of digital infrastructures: a framework for blockchain enabled system and use case analysis by Hawaii International Conference on System Sciences (HICSS)

Blockchain for businesses by Springfield Business Journal

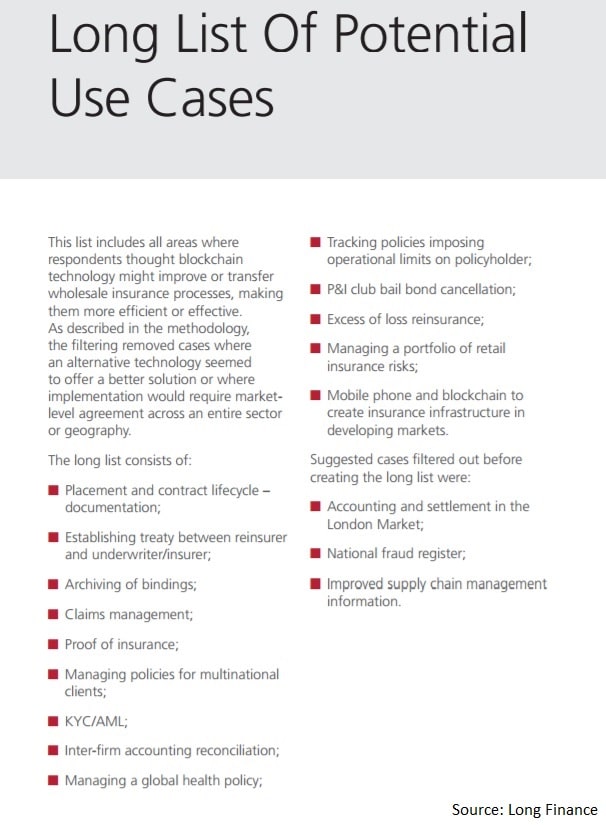

Insurance (InsurTech)

Better security with blockchain also means that individuals will be better placed to seamlessly purchase insurance more securely even without the need for bank accounts – and even across national borders. This feature will prove beneficial especially considering that there are hundreds of billions of people across the world who are currently under-served by insurance companies.

The technology will allow strangers to record simple and enforceable contracts even without the need for a lawyer or an insurance sales person or broker. The improved security that the technology eschews will also make it possible to sell insurance policies and products over the internet without the involvement of brokers – who also rank amongst the major points at which security threats or unethical capitalism might penetrate the insurance contract.

Most big-name insurance companies have even kick-started research initiatives focused on exploiting the four fundamental pillars of blockchain technology for a wide range of applications. Most of these companies are being attracted by the potential that blockchain holds in the addressing of the security and privacy that continues plaguing internet commerce and makes it much more difficult for people to buy insurance policies online.

Seeing as how blockchain transactions are recorded using private or public keys – long strings of characters that humans cannot decipher. As such, insurance companies can create online networks and apply blockchain to improve network security. This will enable people to get insurance while remaining anonymous, while helping third parties securely verify that they shook digitally or via insurance policy agreements.

Further Reading on Blockchain Technology in the Insurance Industry:

Blockchain applications in insurance by Deloitte

Blockchain in the insurance sector by PwC

Blockchain in insurance by EY

Leveraging blockchain to transform the insurance industry by Capgemini

2017 insurance outlook by Deloitte

Changing face of the insurance industry by Infosys

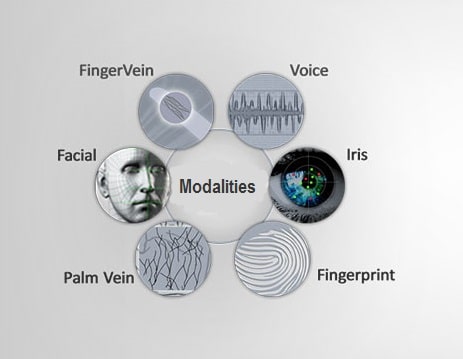

Healthcare (HealthTech)

In healthcare, compelling security with blockchain technology makes it easier for clinics and hospitals to protect the data provided by patients. One of the popular new factors that comes with authentication is biometric technology, which requires no complex combination of symbols, numbers and letters, and no memorisation.

People will simply need to record their characteristic movements, heartbeats, faces, voices, or fingerprints to access their data. Biometrics will be captured by voice recorders and smartphone cameras to improve the security of patient records for hospitals and other healthcare provision centres.

Patients will also be able to check their biometric data against trusted devices that only they own – as opposed to working with a central repository. This will soon emerge at the approach preferred by most people with regards to their healthcare.

The compelling security that is provided by distributed ledger technology could be applied to the healthcare sector. Essentially, patients healthcare history will be recorded on the blockchain ledger similar to a Bitcoin wallet. This will track their health while ensuring that the health records and information posted on the private blockchain ledger cannot be hacked or accessed without permission from the patient.

A great area of application of this concept has been Hyperledger. A new initiative by the Linux Foundation, this technology will build blockchains using a series of processes and standard protocols that will prove useful in a wide variety of sectors and industries where confidentiality, privacy and security are essential. With this and many other advancements, it is likely that blockchain will prove to be the salve in the securing and management of patient records within the health care sector.

Further Reading on Blockchain Technology in the Healthcare Industry:

A case study for blockchain in healthcare by Massachusetts Institute of Technology (MIT)

Solving healthcare pain points with blockchain by Red Chalk Group

Blockchain and the future of healthcare by South Carolina Primary Health Care Association

Micro-identities improve healthcare interoperability with blockchain by ResearchGate

Healthcare foresight by Deloitte

Blockchain: opportunities for health care by Deloitte

Legal/Compliance (RegTech)

The compelling security that blockchain technology begets is one of the advantages that it has over most modern systems. This is one of the reasons why it is essential to address the issues of enforcement, regulations and compliance emanating from the technology.

A good example is centralised utilities, which need to comply with rules about the kinds of public access to provide within their systems. So, will groups of companies looking to set private blockchains need to comply with similar rules?

Other regulatory issues to consider will include clarity over jurisdiction as well as about how to comply with anti-money laundering and know-your-customer laws. Some platforms will actually come with large network effects. For instance, Autonomous Research reports that card networks process around 2000 transactions every second and do so cheaply. This means that merchants have very little incentive to switch.

According to the DTCC, blockchain comes with improved security. For instance, it will make it possible to log and monitor the atypical enterprise environment. One of the first online retailers to take up blockchain in major ways was Overstock. At the time of writing, it is the first company to issue stock on trading platforms powered by blockchain. If similar enterprises wish to switch to blockchain, they need to understand the security benefits they will enjoy by so doing.

Overall, blockchain trading is more secure. It provides a distributed network for the verification of the integrity of transactions, and associated account balances. This means that successful attacks are mathematically impossible.

When you combine the immutability, security and transparency of blockchain, you have a dream-like scenario that compliance officers, regulators, and auditors will benefit from. In areas such as stock trading and others, better security with blockchain will provide a solution for every inefficient processing system – such as the recording of legal contracts, escrow services, and property transfers.

Further Reading on Blockchain Technology in the Legal/Compliance Industry:

How blockchain can revolutionize regulatory compliance by DataArt

Regtech in financial services: technology solutions for compliance and reporting by The Institute of International Financa (IIF)

An innovative regtech approach to financial risk reporting by Atlantis Group

The changing landscape: how to use regtech and make regulatory compliance your strategic advantage by PwC

The future of regulatory productivity, powered by regtech by Deloitte

Regulatory technology services (regtech) by KPMG

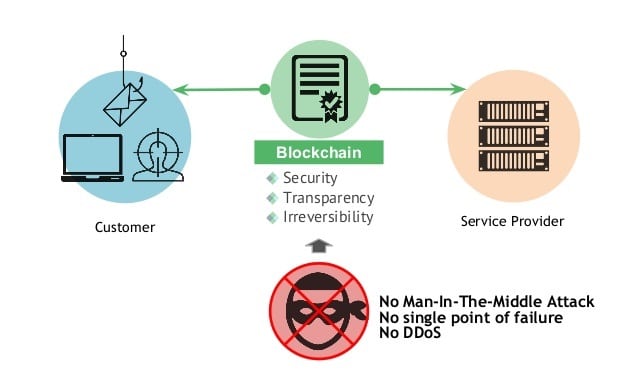

Cyber Security (CyberTech)

Blockchain technology takes away the necessity for thirdparties and its decentralised nature would have major benefits in conditions for enhancing trust. The Brookings Institution has presupposed many scenarios where the removal of the dependability on third parties could prove highly valuable. Some other benefits associated with security includes irreversibility, and automatic traceability.

Passwords can be, and have been, hacked easily. The good news is that the compelling security that comes with blockchain technology could render traditional passwords obsolete and bolster high-level encryption.

Companies will be looking to take advantage of this digital transformation to improve user experience, which is at the core of the design philosophy that drives such transformation. However, most user experiences for executives, frontline employees, business partners and customers tend to start with transactions that are both annoying and come with weak security links – the password.

Blockchain technology will go a long way in making passwords unnecessary. Therefore, stolen and weak passwords, which are the root cause of most cyberattacks in the corporate world, will be a thing of the past. Seeing as how corporate cyber breaches cost millions of dollars in public relations, legal and technological expenses, it follows that both individuals and businesses will benefit from the better security that comes with blockchain, security which will ensure passwords are no longer needed.

Furthermore, when quantum computers become commercially available in the early 2020’s, and quantum blockchains get established, the cyber-security benefits of blockchain technology will become immutable.

Further Reading on Blockchain Technology in the Cyber-Security Industry:

Blockchain & infrastructure (identity, data security) by Massachusetts Institute of Technology (MIT)

Security of blockchain technologies by The Swiss Federal Institute of Technology in Zurich (ETH)

On bitcoin security in the presence of broken crypto primitives by Oxford University

Security protocols and evidence: where many payment systems fail by The University of Campbridge

The security of blockchain based digital voting systems by California Polytechnic University of Pomona

Blockchain, virtual accounts and digital security by Barclays

Disruption Is brewing in digital investment, security, and identity by Forrester

Blockchains in national defense: trustworthy systems in a trustless world by Air University (AU) **

Digital Identities

Better security with blockchain means it will be easier to keep records of ownership and to maintain digital identities. Factom, for instance, has been using blockchain to help governments and companies manage data, keep records, and detail digital identities.

Realty records secure property and financial records secure money. In the same way, citizen records posted on the blockchain will help secure digital identities and credit. All such records will suddenly become harder to be hacked or maliciously changed because they will exist on the distributed public ledger created by blockchain. Furthermore, two-factor passport authentication could be set-up by governments using blockchain technology, which will minimise if not eliminate passport and other identity related fraud.

Blockchain will also replicate this information across the servers running the system containing the digital identities of different individuals and entities. This way, it will be close to impossible to hack the distributed processing network so created. In fact, this is one of the greatest assets that blockchain will provide in the management of digital identities. Additionally, there will be undisputed records and proof of ownership from the identities so created. In the same way, people will own their records and only get to share them with third-parties they trust.

Further Reading on Blockchain Technology in the Area of Identity:

The blockchain identity by Duke University

Towards self-sovereign identity using blockchain technology by University of Twente

A blueprint for digital identity by The World Economic Forum (wef)

Blockchain identity – too good to be true? by Consult Hyperion

The inevitable rise of self-sovereign identity by The Sovrin Foundation

Application of the blockchain for authentication and verification of identity by Tufts University

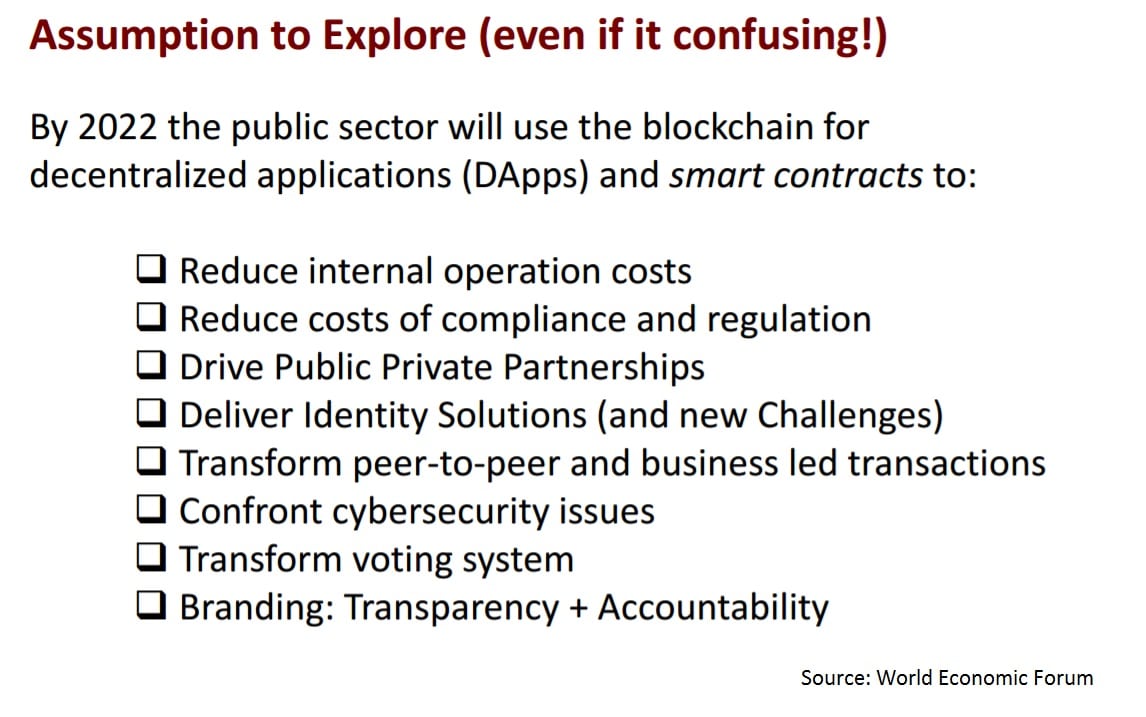

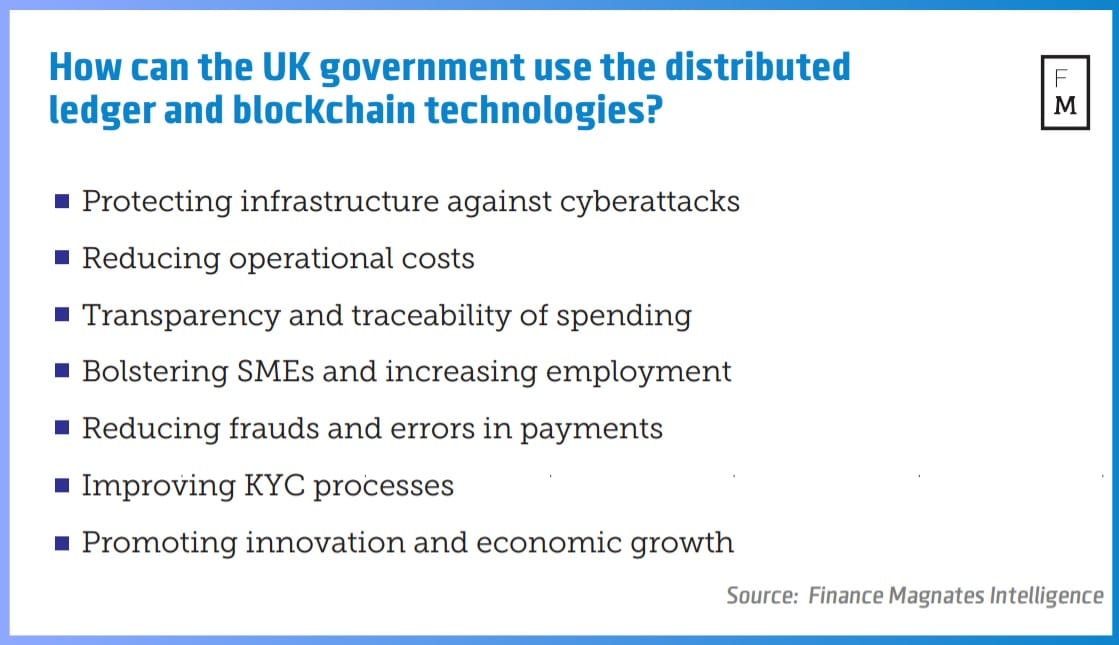

Governments

The improved security that blockchain comes with will prove useful in the changing of the voting industry and removing the vulnerabilities plaguing most voting machines. The technology when applied using quantum computers will, by its design, eliminate completely the need for paper ballots and provide governments with unparalleled security during the voting period.

To exemplify this, Follow My Vote is disrupting the public voting system by capitalising on better security with blockchain. By so doing, the organisation looks to restore faith in the public democracy process.

Organisations like Follow My Vote will make it possible to securely and conveniently vote from a computer, tablet or smart phone. This will be one of the best ways to increase voter turnout. The technology will also offer advancement in transparency since it will provide voters with the unique ability to confirm that their votes were actually counted. At the same time, it will retain the secrecy and sanctity of the ballot, which is crucial for democracy.

Further Reading on Blockchain Technology in Governance:

Blockchain technology and decentralized governance: is the state still necessary? by University College of London

Blockchain: the importance of creating new governance by Gilbert + Tobin

A governance platform and charity for a global society by Borderless

DAOs, democracy and governance by Merkel

The blockchain e-commerce/e-government revolution by Zühlke

Use of blockchain in Estonian government infrastructure by GuardTime

The future of government services by Hennepin

Digital vision for government by Atos

Energy

How can humanity get to a point where utilities get their desired outcomes in the form of fraud protection and privacy for consumers while third party vendors receive access to data to help them aid consumers and run their businesses? The answer lies in the adoption of blockchain technology and the security it eschews.

Blockchain could take over the customer storage functions that utilities currently play. By so doing, it could provide immutable historical records of every usage data and transaction. Additionally, this technology combines cryptographic signatures, key cryptography, hashing functions, distributed systems and peer to peer networks. Although all of these technologies existed before, when cleverly combined they prove useful in securing the energy sector. This is why blockchain has already started being adopted within the energy sector where consumer data is crucial and critical.

By so doing, compelling security with blockchain makes it easier for third party vendors to receive consumer usage data and enjoy fraud detection and protection, consumer anonymity, and privacy. It also enables trust in systems that are being run without middlemen.

Implemented properly, blockchain in the energy sector will be a huge success. Utilities will protect consumers, vendors will be able to access consumer data that has been encrypted unless consumers enable full disclosure, and consumers will enjoy cutting-edge services and products from third party vendors. The new technology will focus on moving humanity closer to the sustainable use of energy. The improved security will also provide opportunities to increase consumer satisfaction and create new business models to serve the new kind of empowered energy consumer.

Further Reading on Blockchain Technology in the Energy Sector:

Blockchain – an opportunity for energy producers and consumers? by PwC

Blockchain in the energy transition by Dena (German Energy Agency)

Blockchain applications to solar panel energy: landscape analysis by Massachusetts Institute of Technology (MIT)

The future of energy systems by gvec

The new energy world order is only a matter of time by Neue Energiewelt (Energy Company)

How disruptive does disruptive change in the energy system need to be … to save our planet? by Wisconsin Energy Institute

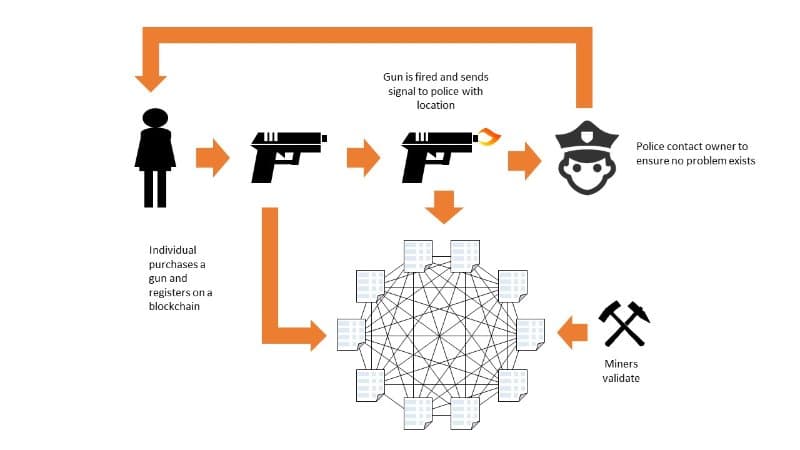

The Internet of Things (IoT)

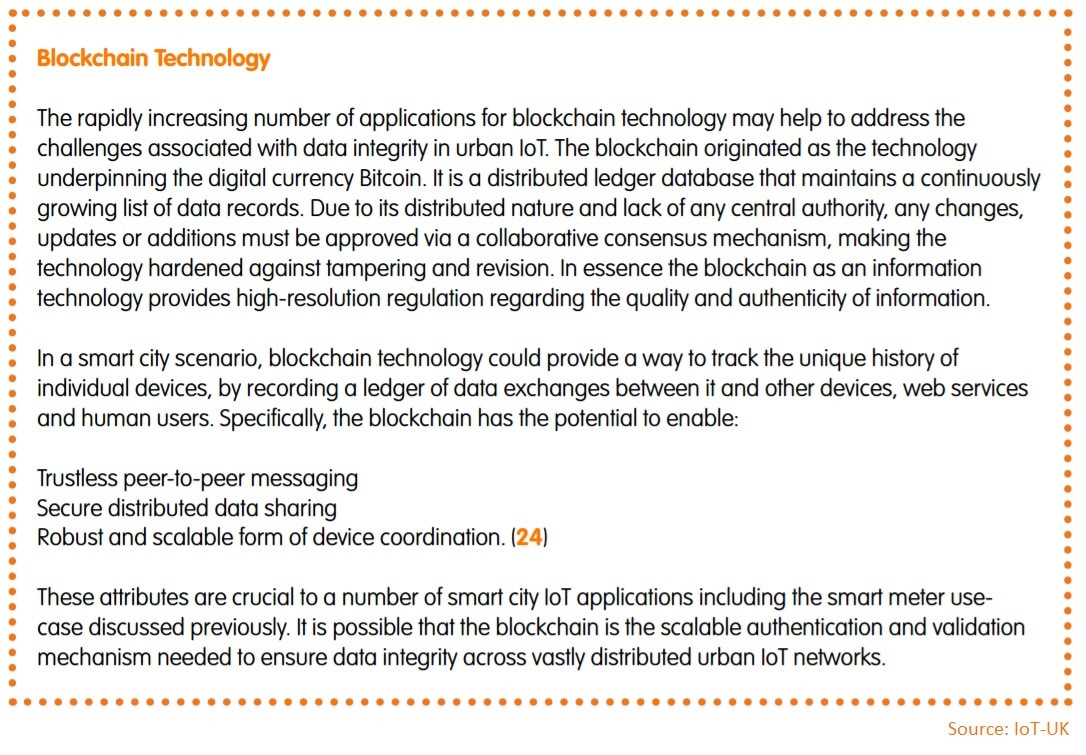

Another promising area of the application of compelling security with blockchain is in the IoT (Internet of Things), which has already started transforming lives. Blockchain technology is likely to allow IoT products to become more secure, autonomous, and able to conduct transactions on their own.

Imagine, for instance, vending machines that can monitor and report on their stock, as well as solicit bids from product distributors and automatically pay when new items are delivered. Of course, all of this will be based on the purchase history of customers.

An alternative area of application of better security with blockchain will be a suite of smart home appliances. These appliances will function in a secure system and be able to bid with each other for priority to ensure that the robo-vacuum, dishwasher, and laundry machine run at appropriate times to minimize electric costs against grid prices.

In the future, smart devices working within a network will be able to send and receive data securely and autonomously react to signals in the market. The great thing is that the improved security that blockchain provides will ensure that such transactions are hidden from the average consumer.

Further Reading on Blockchain Technology in the IoT Industry:

How blockchain will defend IOT by Hitesh Malviya

Leveraging blockchain‐based protocols in IoT systems by The US National Institute of Standards and Technology (NIST)

Blockchains and smart contracts for the internet of things by North Carolina State University (NCSU)

Connecting multiple devices with Blockchain (IoT) by Tallinn University of Technology

Conclusion

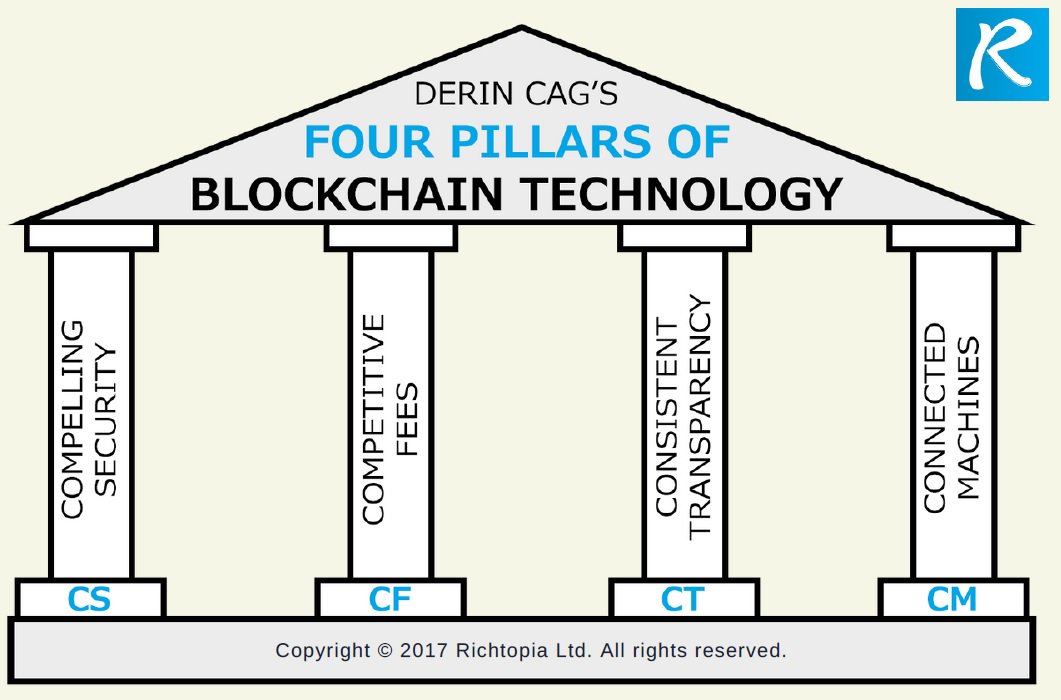

Blockchain technology is still in its infancy. However, the examples above highlight a universal truth – compelling security with blockchain will ensure the technology finds its way to every industry in the world. Furthermore, compelling security is only one of the four pillars of blockchain technology. Stay tuned for parts two, three, and four.