Six insightful wealth management technology trends, and a general outlook on the future of WealthTech.

Global High-Net-Worth Individual (HNWI) wealth has increased over the last decade.

The rate is expected to grow at an average annual rate of 7.7%.

Rising operational costs accompany this as a result of stringent regulation and maintenance of technology infrastructure.

As a consequence of this growth, there has been an emergence of new avenues and trends in wealth technology. Most firms aim at increasing their top lines.

Almost every wealth and asset management firm is struggling to achieve excellence in areas of client experience as well as regular management of transformational change.

What Is the Future of Wealth Technology?

The use of predictive analytics has been applied to get additional insights into client behaviour and improve firms delivery to their added products and services.

It involves extracting information from existing data to determine and show future trends.

Models are, therefore, generated to predict future events and behaviours in wealth technology.

According to the recent research by Aberdeen Group’s Predictive Analytics in Financial Services, the analysis found that asset management firms with predictive analytics achieved an average 11% increase in the number of customers in the past twelve months.

Advisers can apply the use of predictive technology to anticipate the client’s needs and then offer additional products and services.

1. The Adoption of Cloud Computing Platforms in Wealth Technology

Cloud computing has also become a significant trend in wealth technology.

There have been increased compliance requirements which include the Dodd-Frank Act, sectors in Financial Instruments Directive (MiFID), and the Sarbanes-Oxley Act (SOX), asset management.

The conditions make companies gear towards cloud computing to lower the upfront capital expenditure and enhance sustainable growth.

Cloud-based derivatives post trade processing services helps wealth managers to effectively and efficiently maintain compliance.

This aligns with the changing global regulatory environment.

Cloud-based derivatives also lead to market end-to-end post-trade services.

It offers services in asset classes for investment banks and asset management companies.

Cloud computing platforms also increase productivity of client advisers.

Wealth management firms integrate mobile as a key for their customers for valuable service provision and engagement on a personal level.

According to research by CEB Tower Group, financial firms will increase their cloud computing budget.

The growth in cloud computing budgets will enable them to sustain the changing trends in wealth management.

Cloud services help capital markets and financial sectors to save almost 30 per cent of their information technology budget.

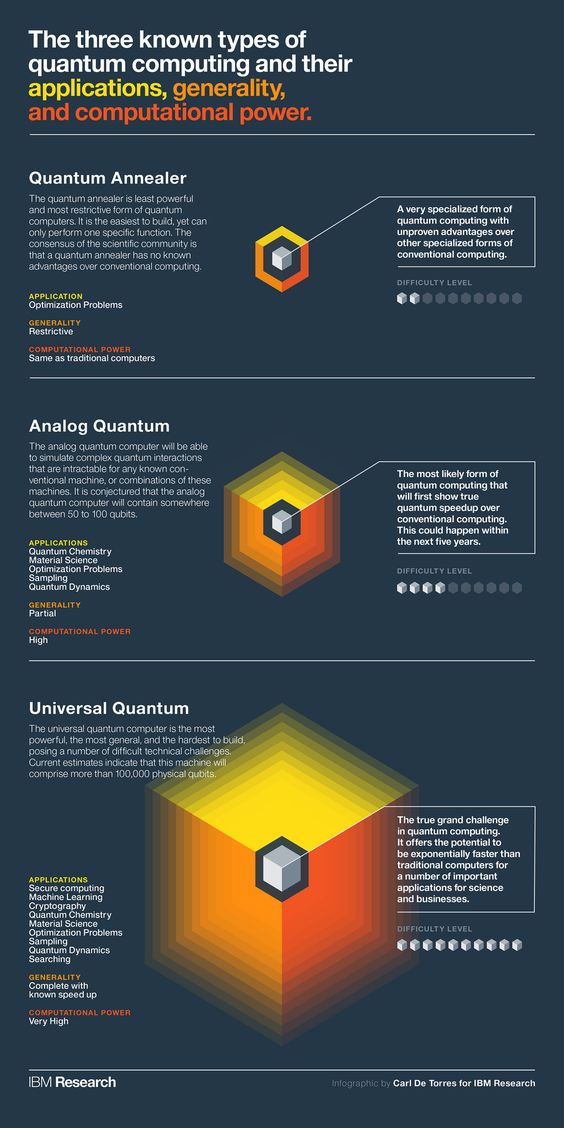

2. The Dawn of the Quantum Computing Age

Quantum computing represents the future of investment managers and the wealth management sectors to overcome financial research challenges.

It involves the use of composite algorithms and systems that use physics and quantum phenomena as the solution to the most complicated mathematical problems.

Most business models are too simple.

Besides, the assumptions made from them being unrealistic, there is the need to analyse such complex systems using sophisticated mathematics.

The need for multiple testing also portrays quantum computing as a more useful method.

According to research conducted by Guggenheim’s Lopez de Prado and Peter Carr, the findings illustrated the potential of quantum computing that will enable asset directors and wealth management companies to solve such complex issues.

The problems include putting money into a set of property over a time horizon that gets divided into multiple steps.

The manager or wealth management firm must, therefore, decide how much to invest in each asset at each level while taking into consideration the account transaction as well as the market-impact costs.

3. More Focus on Social Impact

Focus on social impact is also becoming an emerging trend in wealth technology, according to a survey conducted by Capgemini and RBC Wealth Management.

92% of increased net worth personnel think that driving global impact is crucial in wealth management.

Global impact is, therefore, a significant and essential component in asset management.

The growing popularity of multi-channel service delivery and the increasing digital innovation serve as drivers for this trend.

It also encompasses the emergence of disruptive business standards.

It is thus crucial for firms to develop optimal strategies that influence digital technologies and social media to confront customer preferences.

Though digitisation and the rise of social media are changing existing wealth management business models, new models are gett developed.

The future business survival will highly depend on the younger generation of wealth management firms’ customers.

Nurturing and maintaining stronger relationships with them is thus vital.

Asset management companies need to address challenges in wealth management.

Some of the challenges include increasing digitisation and engaging in more disruptive business models.

They need to focus on available opportunities and not those of the 20th Century.

This will help create wealth for the younger generation without alienating their clients nearing the retirement age.

The opportunities presented by the emerging technologies is vital for wealth management firms.

They can retain their customers which create wealth for the present and their future generations.

The use of digital intelligence helps to gain customer insights.

Increasing the client’s insight will be achieved by giving the right services a key focus in the different areas for wealth management firms in future years.

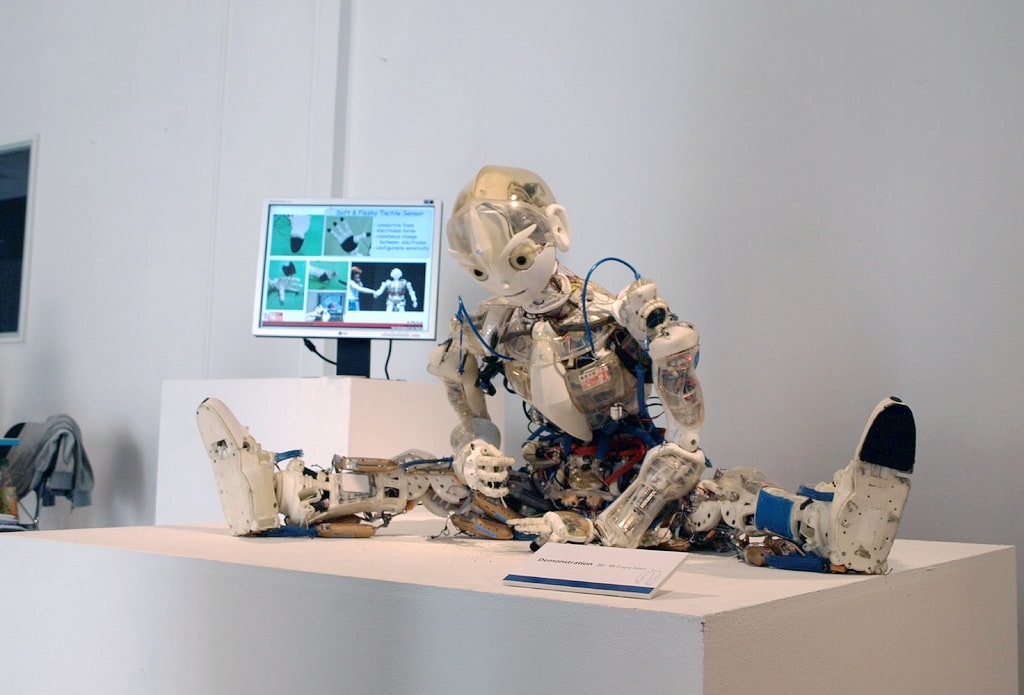

4. The Rise of Automated Advisers

The increase in automated Robo-advisers has also become an emerging trend in wealth technology.

The Robo-adviser industry is growing, with various companies already managing more than $2 billion in property.

Useful investment software allows Robo-advisers to offer clients with low account minimums. It also includes the customisation collection builds, and completely automated financial management points.

Re-balancing for less skilled and experienced investors will also be great news.

Among the most extensive growing US-based robot adviser services is Wealthfront, they provide investment management with prices that are affordable for wealth management firms.

In fact, they require a minimum of $500 per year.

For instance, Invest.com is another leading start-up Robo-adviser platforms.

It specialises in access investments, making them available to anyone for the first time.

The wealth management sector has been the first position in utilising appropriate technologies to promote client experience.

Looking at the continuing rise of Robo-advisers, financial advisers can make intelligent decisions.

Though Robo-advisers are becoming popular, simulation technology is still used.

It is mostly the case where Robo-advisers fall short.

Most firms prefer them due to their lower fees and their ease of use.

5. The Use of Blockchain Technology in WealthTech

Blockchain technology is changing the face of wealth management.

This commonly decentralised distributed ledger technology is under research & development by most investment companies and property management companies around the world.

According to research by Roubini ThoughtLab, it has found that 225 out of the 500 wealth management managers it surveyed had incorporated the technology in some way.

This is by allowing the transactions to be verified electronically over an established network of computers.

A Santander report published in 2015 shows that banks and property management companies could save up to $20bn a year by late 2022.

The result could get achieved by using Blockchain technology in asset management. The report shows that adoption of Blockchain techniques in the asset management sector is highly inevitable.

Furthermore, blockchain technology will create multiple new classes of assets.

6. Adopting Artificial Intelligence in Asset Management

Wealth management firms use artificial intelligence and data mining mechanism to invest in a better way, evaluate the wealth market, and gather customer-specific behaviour.

AI is also used to instantly identify available opportunities that deliver appropriate and relevant services or products to clients.

Due to the rapid growth of such technological advances, arises the establishment of better crime detection mechanisms, automated chatbots, compliance handlers, and more.

With the incorporation of artificial intelligence and asset management, especially for firms which are highly investing in cyber-security, companies could analyse the amount of sensitive data.

AI systems could be optimised across multiple data centres and servers to ensure high-level blockchain security and crime detection measures.

The wealth management companies are becoming increasingly alert to the risk of cybercrimes.

The potential downfalls due to such threats make most large entities apply artificial intelligence services to identify and evade risks happening out of transactions made over the digital dimension. Most asset management sectors incorporate artificial intelligence into their research & development.

In wealth management, decisions form a crucial part.

Artificial intelligence could thus help managers make effective decisions for their clients by automatically research troves of data in collaboration with quantum computing and providing the best results each time.

Conclusion: A Further Look into Future Technologies in the Wealth Management Sector

Technology is continuously acting as an amplifier for the continuous growth of the wealth management sector.

According to a recent Capgemini report entitled: Self-Service in Wealth Management, there is a high demand for digital services.

Wealth management firms and financial institutions are thus in the process of developing an environment that is conducive towards the development of self-services for their clients.

Software automation has been emphasised in the asset management.

According to an article entitled Balazs Fejes, SVP and Global Head of Financial Services at EPAM the benefits of using digital technology and software automation in the wealth management sector includes the increased satisfaction of clients and user experience.

According to recent independent research from Forrester, investors regularly check their investment account balances online more often than on a paper statement.

It portrays the need for software automation in the wealth and asset management sector.

Software automation and the use of innovative technologies in wealth management will in a great way to help advisers with useful audibility and increase traceability, thus provide reductions in liabilities.

Disclaimer: The content on this page is for informational and entertainment purposes only. It is not advice, and should not be taken as such.