The finance sector has advanced over the past decade with developments in computer processing and smartphone technology.

Problems have become more complex.

To deal with these challenges, the finance industry is turning to innovation and application of advanced scientific techniques such as quantum technology.

Quantum computing is a field which applies theories developed under quantum mechanics to solve problems.

There are both pros and cons of the impact this will have on fintech.

Thus far, reasons have existed to believe that when applied to finance, quantum computing could solve growing problems in critical areas, including cybersecurity.

The finance industry has many areas where faster and more secure processing would be welcome.

The financial sector has many transactions run by algorithms.

Using quantum computing would exponentially increase the speed of these transactions, allowing institutions to scale their processing with fewer costs as opposed to employing more human or IT resources.

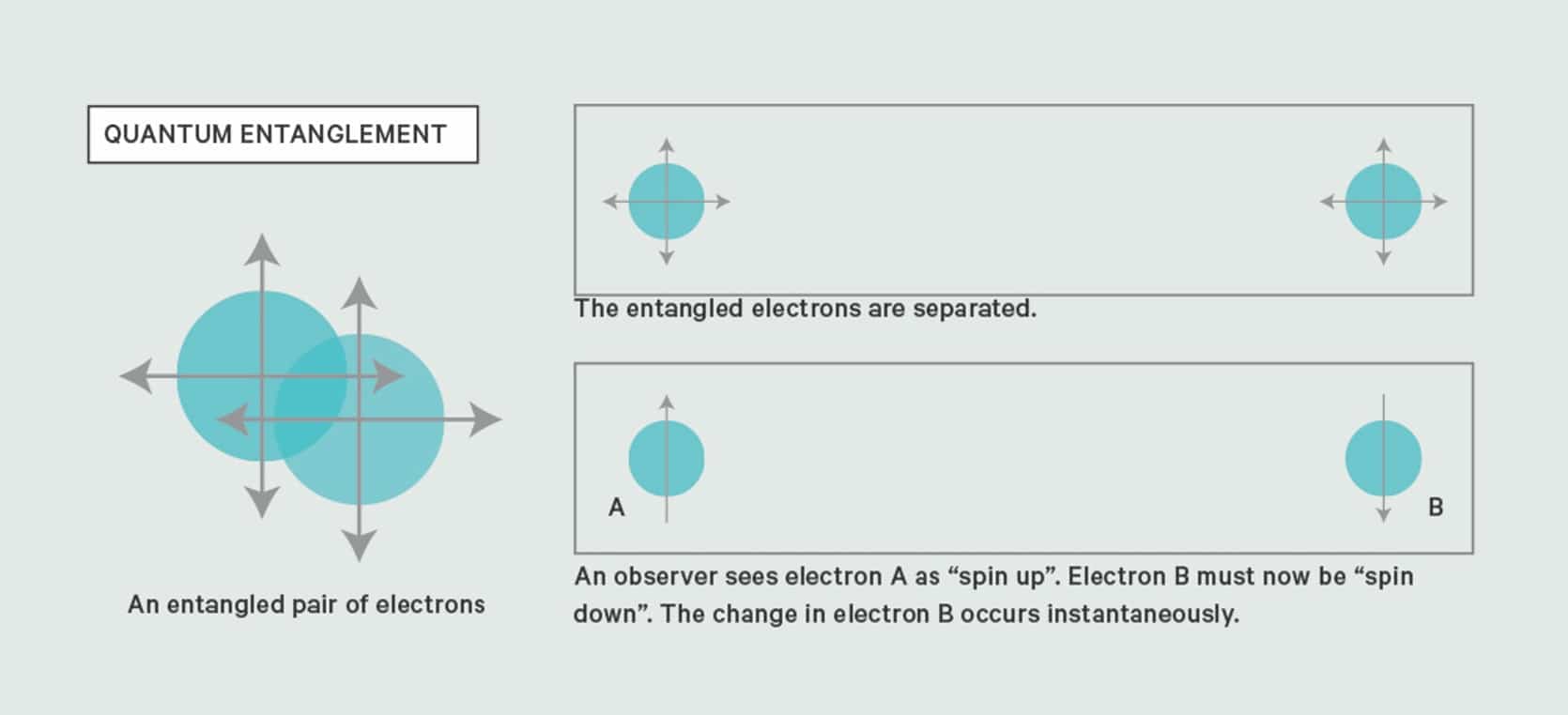

Faster processing is made possible because, in quantum computing, data gets represented using qubits as opposed to traditional binary units (0s and 1s).

Qubits are more flexible and allow for a combination of 0s and 1s simultaneously, as compared to previously where data had to be either a 0 or a 1.

As such, a set of qubits stores more data than traditional bits.

Take this metaphor for example; if fintech is Marvel’s X-Men, quantum computing is the shape-shifting Mystique, big data and blockchain are Xavier’s Cerebro, and Bitcoin is the disruptive Wolverine.

In addition to data processing, fraud detection is also a relevant use-case when it comes to quantum banking.

Quantum computing could get used to detect fraudulent activities by recognising such patterns of behaviour at a much faster rate than conceivable.

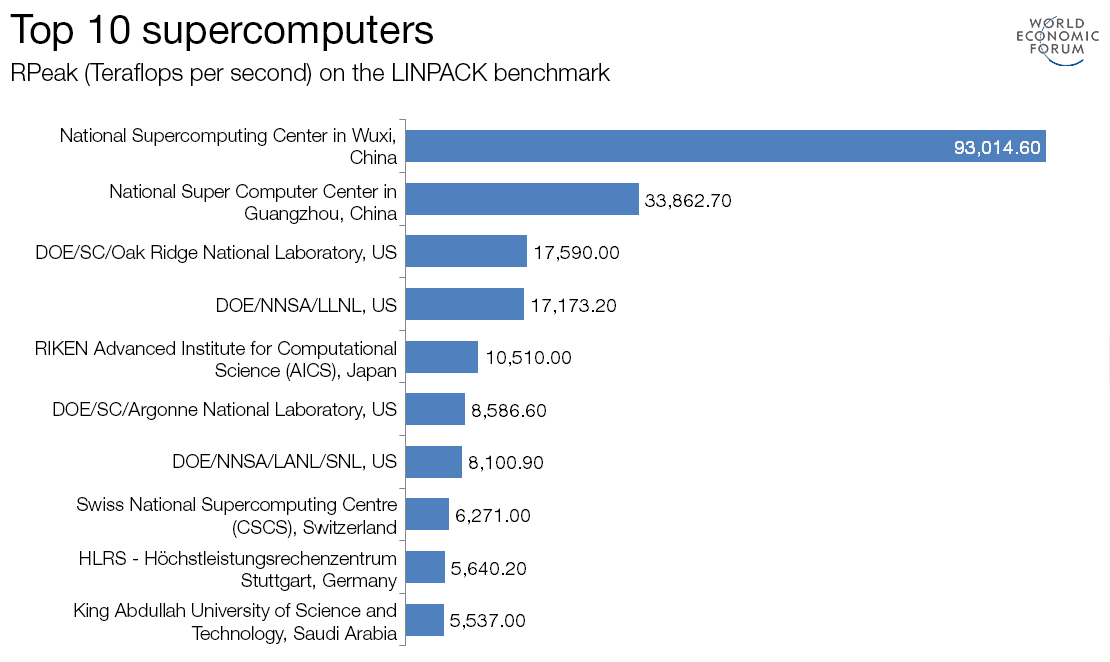

According to Bloomberg, Google’s most advanced quantum computer named Sycamore could solve a specific computational task that a traditional supercomputer takes 10,000 years to solve within 3 minutes.

Ultra-fast quantum computing within financial services could get achieved in conjunction with machine-learning algorithms using Artificial Intelligence (AI).

These two technologies will make constant connections moving forward and get used to forecast future activities with impressive accuracy.

The Open Source Strategy Forum (2017) indicates “Quantum Computing… with key open source initiatives will change the financial services industry forever”.

Four examples of new quantum computing applications in financial services and their implications on the future of banking:

1) Quantum cryptography:

Financial data encoded with quantum cryptography is by far more secure than other kinds of digital security.

The advent of the internet has made it possible for hackers to take control of remote devices and copy or edit confidential data.

One cannot read data encoded in quantum states because they shape-shift by changing states and as such prevent eavesdropping, in addition to other techniques hackers may attempt.

As with most opportunities, there will also be risks, as Ascent (2017) states:

“Quantum related technologies have the potential to massively disrupt a number of areas of IT. In particular, there will be a significant impact on the Financial Services industry… However, with these opportunities also come threats to some conventional security techniques and even business models, as current encryption methods become trivial to break and are therefore rendered useless.”

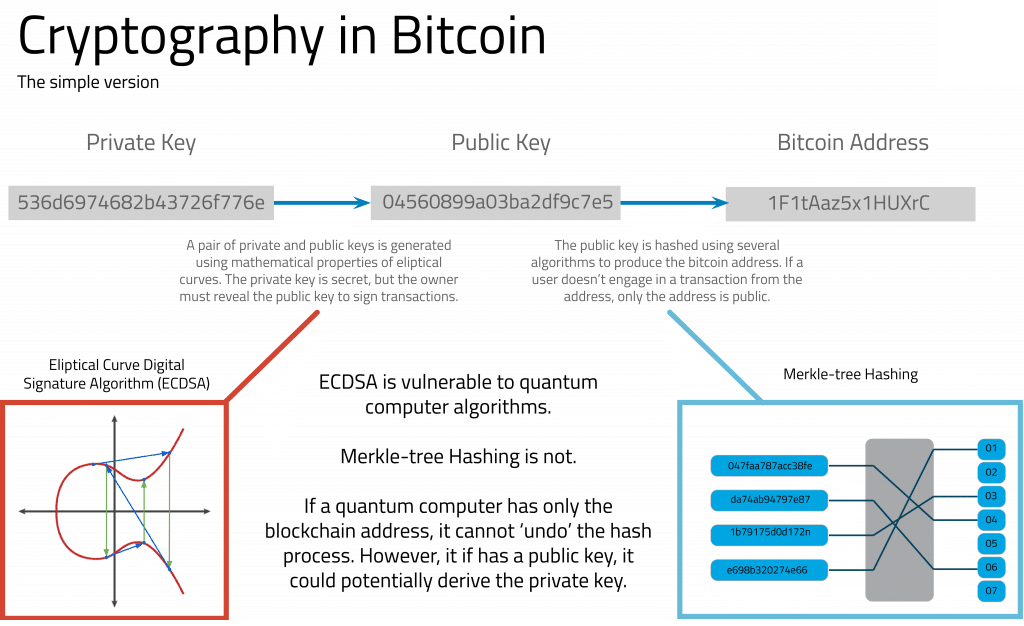

2) Quantum blockchains:

The best solution lies in a combination of quantum computing with blockchain technology.

This solution could be the most hack-proof development of the Internet of Things (IoT) era.

Until then, quantum computers are a significant threat to existing infrastructures, including blockchain, according to Technology Review (2017).

3) Quantum transactions:

Quantum technology’s ability to handle billions of transactions per second will be a welcome addition to banking institutions which are overloaded continuously with vast volumes of transactions.

Downtime on infrastructures using quantum computing will be close to non-existent.

For financial institutions, this will be a relief because their use-cases include a boon for high-speed trading and they will get saved from the embarrassment of crashing systems where users get left with a bad experience or loss of data.

4) Quantum data:

Quantum computers with enough qubits will be able to analyse all of the world’s information almost instantaneously.

Henceforth, they could employ AI to make automated decisions using sets of pre-programmed rules.

Functions such as the approval of bank loans and mortgages will be more automated moving forward.

Doing so will make them faster and more efficient with seamless approvals and no delays.

According to Prado (2016), portfolio managers will no longer need to worry about slippage costs when they rebalance their portfolios because a quantum system will provide them with the best solutions.

Conclusion:

The implications of quantum computing will be far-reaching.

The speed at which significant developments occur will increase. Human interaction will only be relied upon to ratify flagged-up solutions.

The impact of quantum computing on the financial sector will predominantly be a good thing.

With time, advanced AI will make humans freer to focus on life fulfilling functions.

Bibliography

Ascent: Quantum finance opportunities: security and computation [https://atos.net/wp-content/uploads/2017/02/Ascent_White-Paper_Quantum-Finance-FINAL-Nov2016-1.pdf], 2017

Open Source Strategy Forum: “Quantum Computing, Open Source and the Future of the Financial Services Industry” [https://opensourcestrategyforum.org/talks/quantum-computing-open-source-and-the-future-of-the-financial-services-industry/], 2017

Prado, Marcos Lopez de, (2016). Why quantum finance? Quantum for Quants [http://www.quantumforquants.org/quantum-computing/why-quantum-finance/]

Technology Review: “First Quantum-Secured Blockchain Technology Tested in Moscow” [https://www.technologyreview.com/s/608041/first-quantum-secured-blockchain-technology-tested-in moscow], 2017]