I think, perhaps, that I am not normal.

I read a fascinating (and, depressing) study by UBS recently, titled “When is enough … enough. Why the wealthy can’t get off the treadmill.” I’ll summarize the key findings and my thoughts in today’s article. If you’d like to see the original study simply click here.

When Is enough …. enough? Have you thought about it? Have you determined, for yourself, the point at which you have “enough”? For me, it’s best to answer that question as soon as possible after you read this article, and certainly before you reach the pre-determined point of “enough” in your financial life.

Here, then, is my answer: When my financial resources are enough to cover my expected spending requirements for the rest of my life, I have enough. Easily said, but there’s oh so much behind those words. What are your “expected spending requirements”? What’s “enough” lifestyle? What’s “enough” car? What’s “enough” house? What does “sufficient” mean? A treasure trove, perhaps, of future blog posts, but I digress.

I think, perhaps, that I am not normal. I take pride in my abnormality. Intrigued? Read on.

I know the answer to what is enough. Almost to the penny. I have a cash flow projection through age 95 that shows when my wife and I have enough. We’re not there yet, but we’re close. We’ll know when we get there, and we know what we’ll do at that time.

Will you know when you get to “enough”? It seems, based on the UBS study, that “normal” is NOT knowing when you have enough. Here is a summary of the (depressing) UBS findings, along with my thoughts on how I’d urge you to live an abnormal life:

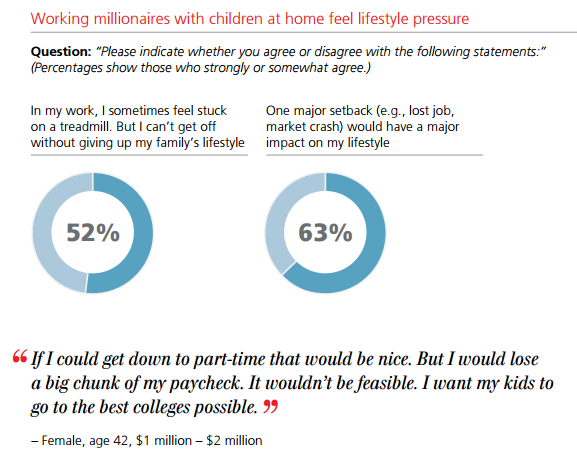

1. Millionaires Feel Stuck On A Treadmill They Can’t Get Off

“Half of millionaires with less than $5M – and 63% of those with children at home – believe that one wrong move….would have a major impact on their lifestyle.

The Retirement Manifesto’s Abnormal Solution: Live well on your means, avoid “lifestyle inflation” (when your income increases, don’t increase your materialistic wants), give yourself 10% of luxury, build a 6 month emergency fund and be more charitable.

2. Billionaires Worry That Wealth Will Spoil Their Children

“Billionaires spend a lot of time and effort working to build wealth, but in the end their biggest regrets…..are not spending enough time with family……64% of billionaires with children feel they sacrificed time with their family to get where they are.” Two out of three billionaires believe their children take things for granted. Half believe their children will fail to take full advantage of the opportunities they’ve been given.

The Retirement Manifesto’s Abnormal Solution: Prioritize time with your kids while you still have the chance. Read “The Top 5 Regrets People Have On Their Deathbed“. Find opportunities to instill your values and principles throughout their childhood. Do what we did – tell your kids they should expect no inheritance. Make them realize they have to earn their way. Take Solomon’s recommendation to “Raise up a child in the way they should go, and when they are old they will not depart from it.” All parents have concerns (mine certainly did!), but most figures it out by the time they hit their 30’s. If not, they’re the ones that will live with the consequences.

And The Most Concerning Finding Of The Study

3. Despite Their Success, Billionaires and Multi Millionaires Keep Striving For More

“Enough is not enough for many billionaires to be fully satisfied, because lifestyle expectations rise along with net worth”.

The Retirement Manifesto’s Abnormal Solution: STOP IT ALREADY. A certain country song comes to mind. You know the one – the woman who crashes her brand new Corvette because she’s watching with envy the new Mercedes Benz drive by. This issue is, to me, perhaps the biggest obstacle folks have to a truly happy life. Make it a priority, early on, to intentionally choose to be content with less. Don’t keep up with the Jones. Don’t let your lifestyle increase as your career progresses.

It’s a choice, and it’s entirely up to you.

Do you know when enough … is enough?