“No one can fool me!” could be something you say, honoured of being so savy.

This should pop your bubble:

If you are not frequently fooled, then you are not reaching enough people or do not have a firm belief in people’s reliability, truth, or ability.

If you are not misled periodically, you are not enhancing your human-element; you are being deprived of precious favorable circumstances to associate with those who may cultivate your journey.

A Back-Up Plan for Arrears

Each enterprise has a back-up plan for the arrears. Ever pondered for what reason or purpose?

A corporation may put a restriction on credit to guarantee that all its borrowers pay back; in the worst-case scenario, they may choose to function just using money in coins or notes. That, without doubt, would tend to any worries regarding arrears. So for what reason don’t, they apply such actions?

For the reason that it’s not beneficial.

The enterprise does not have psychic-powers to know which clients will pay back and which will not. When it gives credit, it is betting on the odds.

Two forms of mistakes the enterprise could make: Form 1 is to give credit to a client that ends up in arrears. This may be called “a test result which wrongly indicates that a particular condition or attribute is present.” meaning that the enterprise’s evaluation was optimistic when it should have been pessimistic. Form 2 is to deny credit to a customer that would pay back. Let us call this a “false negative,” meaning that the company’s assessment is harmful when it should have been positive.

One can only reduce the chances of form 1 mistakes by expanding the opportunities of form 2 mistakes, and the other way around.

A corporation can trim-down the chances of taking on credit requests from the “wrong” clients (form 1) by toughening credit guidelines. Forbidding these dry clients is an advantage. But the issue is that stricter credit guidelines mean higher chances of turning down credit requests from the “right” clients (form 2). Forbidding these valuable clients is pricey.

A bottom-line-boosting corporation will select credit guidelines that make perfect use of the mixture of form 1 advantage—less harmful credit giving—and form 2 damages—less positive clients. Other than under extreme circumstances, this merger will welcome a few negative loans for a more significant client-base.

A Back-Up Plan for Poor Quality Associates

Emphasize with the corporation mentioned above, and connect with your clients. Your cashflow is the firm belief in people’s reliability, truth, or ability and your gains are those who take care of you.

You could confine your belief in people’s reliability, truth, or ability; to hedge against deception; in the worst-case scenario, you could even choose not to believe in the reliability, authenticity, or capacity of any person. That would solve any worries about being decepted. So for what reason shouldn’t it be done?

Due to the reason that it isn’t fruitful.

You do not have psychic powers to be aware of who will respect your secrets and who will not. When you believe in peoples reliability, truth, or ability, you are betting on odds.

Two forms of mistakes that could be made: Form 1 is to believe in someone’s reliability, truth, or ability that will betray you. This “improperly indicates presence of a condition.” Form 2 is not to believe in someone’s reliability, truth, or ability, someone that will not betray you. This “improperly indicates presence of a condition when, in reality, it is not.”

Keep in mind: You can only decrease the chances of form 1 mistake by expanding the opportunities of form 2 mistakes, and the other way around.

You can decrease the chances of believing in a “dishonest” person (form 1) by toughening your principles. Prohibiting these negative people from your sphere of trust is a gain. But tougher principles mean a greater possibility of turning down an “honest” person (form 2). Prohibiting these honest people from your sphere of trust is pricey.

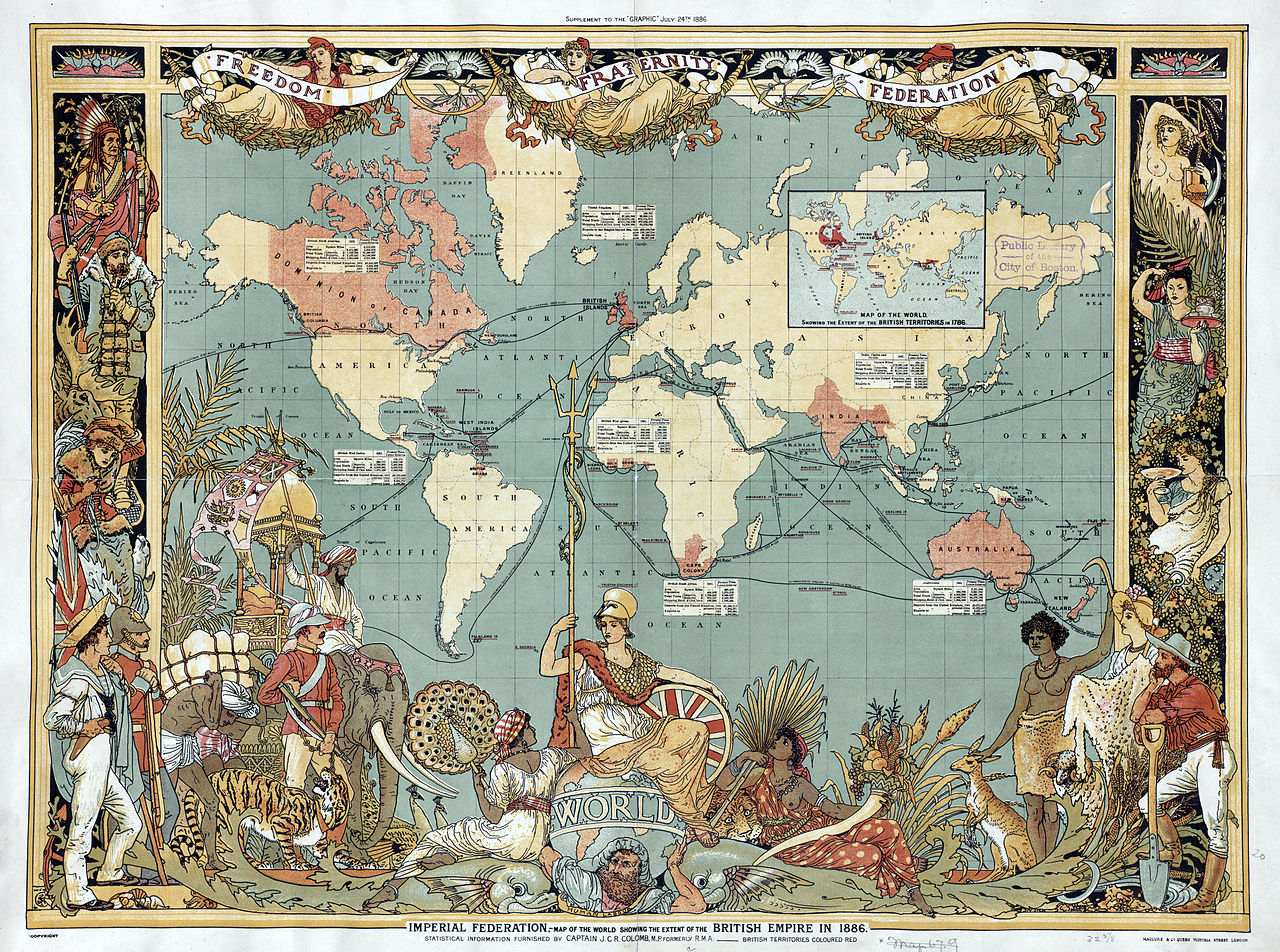

A life-magnifying technique will pick out the principles that make perfect use of the mixture of form 1 advantage—less betrayals—and form 2 catastrophes—less trusting connections. Other than in under intense circumstances, this merger will welcome a few betrayals for a bigger web of trust.

For this reason, it was written at the start that if you are not fooled frequently, then you are not reaching enough people or do not have a firm belief in people’s reliability. And this is the reason you may contemplate building a subjective grant for “poor quality associates.”

When someone is disloyal to me, I feel horrible. I am aware that to associate with other humans, it is necessary to take chances, and that frequently someone will be disloyal. But at the time this occurs, it is awful. I am not just a person of sound mind; my emotional point of view hates the trouble. In such times I gain a desire to remove myself, to restrain from others who may bring pain upon me.

I’ve come up with a slogan for such times: Seemingly good experiences are not constantly good, and the real good does not constantly seem like a good experience.

It feels horrible to be betrayed, but I am aware that it is good—in modest quantities. The odd shot of negative emotions is the bill paid for the passionate connections that beautify my life.

And in hindsight, I deduce after reflection on my professional journey that all my accomplishments, my fiscal situation, and my beloved buddies, are now the reason to arrange an even greater quota for poor quality associates, which then allows me to possess an even bigger web of trust.

Hey, you:

How much risk of disloyalty and double-crossing are you ready to accept for the sake of trust? Leave a comment and allow us to know.