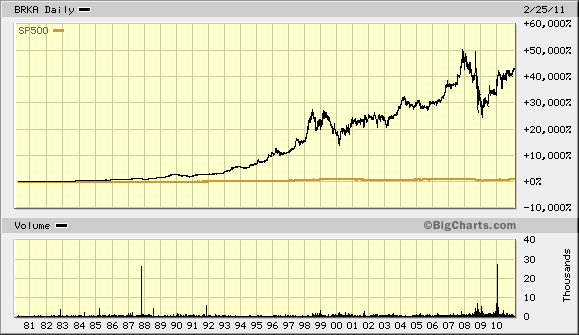

Berkshire Hathaway Inc. is an American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States, that oversees and manages a number of subsidiary companies. The company averaged an annual growth in book value of 20.3% to its shareholders for the last 44 years, while employing large amounts of capital, and minimal debt. Berkshire Hathaway stock produced a total return of 76% from 2000–2010 versus a negative 11.3% return for the S&P 500.

The company is known for its control by investor Warren Buffett, who is the company’s chairman and CEO. Buffett has used the “float” provided by Berkshire Hathaway’s insurance operations (paid premiums which are not held in reserves for reported claims and may be invested) to finance his investments. In the early part of his career at Berkshire, he focused on long-term investments in publicly quoted stocks, but more recently he has turned to buying whole companies. Berkshire now owns a diverse range of businesses including confectionery, retail, railroad, home furnishings, encyclopaedias, manufacturers of vacuum cleaners, jewellery sales; newspaper publishing; manufacture and distribution of uniforms; as well as several regional electric and gas utilities.

According to the Forbes Global 2000 list Berkshire Hathaway is the fifth largest public company in the world.

BUSINESS INFORMATION

Insurance group

Insurance and reinsurance business activities are conducted through approximately 70 domestic and foreign-based insurance companies. Berkshire’s insurance businesses provide insurance and reinsurance of property and casualty risks primarily in the United States. In addition, as a result of the General Re acquisition in December 1998, Berkshire’s insurance businesses also included life, accident and health reinsurers, as well as internationally based property and casualty reinsurers. Berkshire’s insurance companies maintain capital strength at exceptionally high levels. This strength differentiates Berkshire’s insurance companies from their competitors. Collectively, the aggregate statutory surplus of Berkshire’s U.S. based insurers was approximately $48 billion as of December 31, 2004 (2004 -12-31). All of Berkshire’s major insurance subsidiaries are rated AAA by Standard & Poor’s Corporation, the highest Financial Strength Rating assigned by Standard & Poor’s, and are rated A++ (superior) by A. M. Best with respect to their financial condition and operating performance.

Utilities and energy group

Berkshire currently holds 89.8% of the MidAmerican Energy Holdings Company. At the time of purchase, Berkshire’s voting interest was limited to 10% of the company’s shares, but this restriction ended when the Public Utility Holding Company Act of 1935 was repealed in 2005. A major subsidiary of MidAmerican is CE Electric UK.

Manufacturing, service, and retailing

Clothing

Berkshire’s clothing businesses include manufacturers and distributors of a variety of clothing and footwear. Businesses engaged in the manufacture and distribution of clothing include Union Underwear Corp. – Fruit of the Loom, Garan, Fechheimer Brothers and Russell Corporation. Berkshire’s footwear businesses include H.H. Brown Shoe Group, Acme Boots, Brooks Sports and Justin Brands. Berkshire acquired Fruit of the Loom on April 29, 2002 for $835 million in cash. Fruit of the Loom, headquartered in Bowling Green, Kentucky, is a vertically integrated manufacturer of basic clothing. Berkshire acquired Russell Corporation on August 2, 2006 for $600 million or $18.00 per share.

Building products

In August 2000, Berkshire entered the building products business with the acquisition of Acme Building Brands. Acme, headquartered in Fort Worth, Texas, manufactures and distributes clay bricks (Acme Brick), concrete block (Featherlite) and cut limestone (Texas Quarries). It expanded its building products business in December 2000, when it acquired Benjamin Moore & Co. of Montvale, New Jersey. Moore formulates, manufactures and sells primarily architectural coatings that are available principally in the United States and Canada.

In 2001, Berkshire acquired three additional building products companies. In February, it purchased Johns Manville which was established in 1858 and manufactures fiber glass wool insulation products for homes and commercial buildings, as well as pipe, duct and equipment insulation products. In July, Berkshire acquired a 90% equity interest in MiTek Inc., which makes engineered connector products, engineering software and services, and manufacturing machinery for the truss fabrication segment of the building components industry and is headquartered in Chesterfield, Missouri. Finally in 2001, Berkshire acquired 87 percent of Dalton, Georgia-based Shaw Industries, Inc. Shaw is the world’s largest carpet manufacturer based on both revenue and volume of production and designs and manufactures over 3,000 styles of tufted and woven carpet and laminate flooring for residential and commercial use under approximately 30 brand and trade names and under certain private labels. In 2002, Berkshire Acquired the remaining 12.7 percent of Shaw.

On August 7, 2003, Berkshire acquired Clayton Homes, Inc. Clayton, headquartered near Knoxville, Tennessee, is a vertically integrated manufactured housing company. At year-end 2004, Clayton operated 32 manufacturing plants in 12 states. Clayton’s homes are marketed in 48 states through a network of 1,540 retailers, 391 of which are company-owned sales centers. On May 1, 2008, Mitek acquired Hohmann & Barnard a fabricator of anchors and reinforcement systems for masonry and on October 3 of that year, Mitek acquired Blok-Lok, Ltd. of Toronto, Canada. On April 23, 2010, Mitek acquired the assets of Dur-O-Wal from Dayton Superior Corporation.

Flight services

In 1996, Berkshire acquired FlightSafety International Inc. FSI’s corporate headquarters is located at LaGuardia Airport in Flushing, New York. FSI engages primarily in the business of providing high technology training to operators of aircraft and ships. FlightSafety is the world’s leading provider of professional aviation training services. Berkshire acquired NetJets Inc. in 1998. NetJets is the world’s leading provider of fractional ownership programs for general aviation aircraft. In 1986, NetJets created the fractional ownership of aircraft concept and introduced its NetJets program in the United States with one aircraft type. In 2004, the NetJets program operated 15 aircraft types.

Retail

The home furnishings businesses are the Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture Company, and Jordan’s Furniture, Inc. CORT Business Services Corporation was acquired in 2000 by an 80.1% owned subsidiary of Berkshire and is the leading national provider of rental furniture, accessories and related services in the “rent-to-rent” segment of the furniture rental industry.

In May 2000, Berkshire purchased Ben Bridge Jewelers. A chain of jewellery stores established in 1912 with locations primarily in the western United States. This joined Berkshire’s other jeweler acquisition, Helzberg Diamonds. Helzberg is a chain of jewellery stores based in Kansas City that began in 1915 and became part of Berkshire in 1995.

In 2002, Berkshire acquired The Pampered Chef, Ltd., the largest direct seller of kitchen tools in the United States. Products are researched, designed and tested by The Pampered Chef, and manufactured by third party suppliers. From its Addison, Illinois headquarters, The Pampered Chef utilizes a network of more than 65,000 independent sales representatives to sell its products through home-based party demonstrations, principally in the United States.

See’s Candies produces boxed chocolates and other confectionery products in two large kitchens in California. See’s revenues are highly seasonal with approximately 50% of total annual revenues being earned in the months of November and December. Dairy Queen services a system of approximately 6,000 stores operating under the names Dairy Queen, Orange Julius and Karmelkorn that offer various dairy desserts, beverages, prepared foods, blended fruit drinks, popcorn and other snack foods.

In November 2012, Berkshire announced they would acquire the Oriental Trading Company, a direct marketing company for novelties, small toys, and party items.

Other non-insurance

In 1977, Berkshire Hathaway purchased the Buffalo Evening News and resumed publication of a Sunday edition of the paper that ceased in 1914. After the morning newspaper Buffalo Courier-Express ceased operation in 1982, the paper began to print morning and evening editions, currently printing only a morning edition. It remained Berkshire’s only newspaper holding until the purchase of the Omaha World-Herald in December 2011. In June 2012, Berkshire Hathaway purchased 63 newspapers from Media General Inc. of Richmond, Va., including the Richmond Times-Dispatch and the Winston-Salem Journal.

On December 25, 2007, Berkshire Hathaway acquired Marmon Holdings Inc. Previously it was a privately held conglomerate owned by the Pritzker family for over fifty years, which owned and operated an assortment of manufacturing companies that produce railroad tank cars, shopping carts, plumbing pipes, metal fasteners, wiring and water treatment products used in residential construction.

And in International (designer and manufacturer of fine jewelry), founded by the Buddhist teacher Geshe Michael Roach, is a division of The Richline Group, Inc., a wholly owned subsidiary of Berkshire Hathaway formed in 2007.

Berkshire acquired McLane Company, Inc. in May 2003 from Wal-Mart Stores, Inc., which brought on other subsidiaries such as Professional Datasolutions, Inc. and Salado Sales, among others. McLane provides wholesale distribution and logistics services in all 50 states and internationally in Brazil to customers that include discount retailers, convenience stores, quick service restaurants, drug stores and movie theatre complexes. Scott Fetzer Companies – The Scott Fetzer Companies are a diversified group of 21 businesses that manufacture and distribute a wide variety of products for residential, industrial and institutional use. The three most significant of these businesses are Kirby home cleaning systems, Wayne Water Systems and Campbell Hausfeld products. Scott Fetzer also manufactures Ginsu Knives.

In 2002, Berkshire acquired Albecca Inc. Albecca is headquartered in Norcross, Georgia, and primarily does business under the Larson-Juhl name. Albecca designs, manufactures and distributes custom framing products, including wood and metal molding, matboard, foamboard, glass, equipment and other framing supplies. Berkshire acquired CTB International Corp. in 2002. CTB, headquartered in Milford, Indiana, is a designer, manufacturer and marketer of systems used in the grain industry and in the production of poultry, hogs, and eggs. Products are produced in the United States and Europe and are sold primarily through a global network of independent dealers and distributors, with peak sales occurring in the second and third quarters.

Finance and financial products

Berkshire acquired and storage trailers, chassis, intermodal piggyback trailers and domestic containers.

Clayton’s finance business, (loans to manufactured home owners), earned $206 million down from $526 million in 2007. Loan losses remain 3.6% up from 2.9%.

Investments

Equities – beneficial ownership

This includes some of the companies where a Berkshire Hathaway stake is more than $1 billion market value at yearend, as reported in the 2011 annual report. In alphabetical order:

American Express Co. (13.0%)

BYD (9.9%)

The Coca-Cola Company (8.8%)

IBM (5.5%)

Kraft Foods (4.5%)

Moody’s Corporation, owner of Moody’s Analytics (12.5%)

Munich Re (10.5%)

Wells Fargo (7.6%)

Wal-Mart (1.1%)

Bonds

As of 2008, Berkshire owns $27 billion in fixed income securities, mainly foreign government bonds and corporate bonds.

Other

In 2003, Pepsi paid Berkshire $10 million to insure against a contest Pepsi held which had a potential $1 billion prize. The prize had a very small chance of being won and it was not won by anyone.

In 2008, Berkshire purchased preferred stock in Wrigley, Goldman Sachs, and GE totaling $14.5 billion.

Berkshire made $3.5 billion on its investment in preferred shares of Goldman Sachs. Berkshire and Buffett have since been criticized for Buffett’s defense of Lloyd Blankfein’s $13.2 million pay package while they owed the United States Department of Treasury $10 billion in Troubled Asset Relief Program money.

On May 1, 2010 at the Berkshire shareholders meeting, Buffett also defended Goldman over $1 billion in collateralized debt obligation fraud allegations saying that its clients made a calculated risk.

On November 3, 2009, Berkshire Hathaway announced that, using stock and cash totaling $26 billion, it would acquire the remaining 77.4 percent of the Burlington Northern Santa Fe Corporation, parent of BNSF Railway, that it did not already own. This was the largest acquisition to-date in Berkshire’s history.

On March 14, 2011, Berkshire Hathaway announced that it would acquire the Lubrizol Corporation for $9 billion in cash, a deal that was described as one of the largest deals ever for Berkshire Hathaway.

On August 26, 2011, Berkshire Hathaway purchased $5 billion of preferred shares in Bank of America. In 2007, Buffet had also bought 8.7 million shares, quickly increasing the stake to 9.1 million shares in the midst of the subprime crisis.

On May 17, 2012, it was announced that Berkshire Hathaway will be acquiring Media General’s newspaper division (excluding The Tampa Tribune) for $142 million in cash; these newspapers will be merged into Berkshire Hathaway subsidiary BH Media Group under the World Media Enterprises division, a sister division to the Omaha World-Herald Company.

In June 2012, it was announced that Berkshire Hathaway will be acquiring Texas dailies The Eagle from Bryan-College Station and the Waco Tribune-Herald.

The company also owns a stake in newspaper publisher Lee Enterprises, having bought some of its debt after it filed bankruptcy

BERKSHIRE HATHAWAY – MISSION STATEMENT

” Deliver the right parts exactly on time, exceed our internal and external customer requirements through continuous improvement, and provide a place for hard-working, dedicated, knowledgeable and ethical people who believe in the company. “

OWNERSHIP STRUCTURE

We all know that the prime investment vehicle for Warren Buffett is Berkshire Hathaway, situated in Omaha, Nebraska, but what is Berkshire Hathaway and how did Buffett get involved?

The Hathaway Manufacturing Company was started in 1888 by Horatio Hathaway, a China trader, with profits from whaling in the Pacific. The business of the company was to mill cotton and it made big profits until the start of the decline of the cotton industry after World War 1.

Seabury Stanton, who put much of his own money into the company to keep it going, ran it during these years.

After the Depression, the company once again came into boom years, with off years from time to time. In the 1950s, Stanton decided to merge the company with Berkshire Fine Spinning Associates Inc, a milling company that had operated since the early 19th century.

The merged company was huge, with 15 plants, over 12000 employees and revenue of over 120 million dollars. Its headquarters were in New Bedford.

Seabury Stanton was a miller and a manager with the overriding aim of keeping the business going but he was not a financial expert and he continued to plough back most of the company’s earnings into working capital, despite ever decreasing cotton prices, resulting from increased competition at home and abroad.

There was internal division in the company between the old stylers and those who wanted to get involved in emerging products.

By the end of the 1950s, the company had closed seven of its plants and laid off a large number of workers. Its stock price had fallen and many analysts had written it off.

In 1962, Buffett started to buy shares in the company, believing that its then price was substantially below its intrinsic value. By 1963, Warren Buffet and his associates were the largest stockholders and Buffett began to take a more active interest in the company. There was increasing dissension between him and Jack Stanton who had taken over the Leadership of the company from his father.

Buffett gradually increased his shareholding to 49 per cent and used his votes to change the management of the company. He became Chairman of the executive committee and installed Ken Chace as President to run it. Buffett would leave the milling operations of the company to the new President; he would concern himself with the financial structure of the company.

It is interesting to see that, even at this stage of his life, Buffett would not entertain a stock option package for the executive team. He was prepared to pay good salaries with incentives, provide loans to allow executives to buy shares in the company, but no stock options. There was to be no free ride for the management team.

By now, the shares that Buffett had bought at an average cost of about $15 were worth $18 a share and the company had only two operative mills left. Only 2300 employees remained.

After Warren Buffett took control of Berkshire Hathaway, the company operated in dual roles. First, it maintained its core business of textiles; secondly, Buffett gradually began to use it as an investment vehicle.

As far as textiles were concerned, Buffett realised the difficulties and future problems for textile mills but for various reasons persevered, apparently for altruistic and non-altruistic reasons. He recognised that closure of the plants would cause job losses and community dysfunction but also thought that he could operate the business profitably. He said that he would not shut down a business with lower than average profits just to add a small portion to business returns.

However as time passed, Buffett realised that the business was in trouble from increasing foreign competition and high structural costs. The end was near. In 1985, the company discontinued its historic role in the textile business. Even Warren Buffett could not turn around a company whose business operations had become structurally unprofitable.

In about 1967, Buffett turned the company’s eyes towards the insurance business, negotiating the purchase of two Nebraska companies, National Indemnity and National Fire and Marine Insurance. Now the insurance business is risky, subject to strong competitive forces, and strongly reliant on astute management. Why would an investor like Buffett exchange one type of commodity business (textiles) for another?

The reason is that insurance companies charge premiums against a risk that may or may not eventuate, generating large amounts of cash that lie about looking for something to do. This allows the insurance company to invest spare monies to gain further profits over and above that generated by the insurance business itself. However, the investments need to be in liquid assets that can be realised when and if necessary to pay claims. The prime market for liquid investment is stocks and bonds.

There is also another factor, as Buffett knew. If an insurance company is financially strong, customers and agents of that insurance company will have confidence in its ability to pay claims, allowing the company to remain vibrant and viable even when insurance margins are falling through increased competition or larger than usual claim years.

Buffett also maintained a policy in the companies that concentrated on premium safety rather than in volume of business. If the premiums had a sound basis, the companies would do as much business at those prices as it could. If the prices were not rational, the company would not write the business and it was irrelevant if volumes dropped off. If customers chose to buy elsewhere that was up to them.

If you think about it, this is just a variation of Buffett’s concept of, if necessary, waiting forever to buy a share at the right price.

This first investment in insurance was the start of Berkshire Hathaway’s rise to the investment legend it has become today. In a few years, Berkshire Hathaway would acquire GEICO General Insurance Company, which would add to Buffett’s profits through both insurance premiums and the huge cash flow that would allow further stock investments.

Written by: S. Virmani