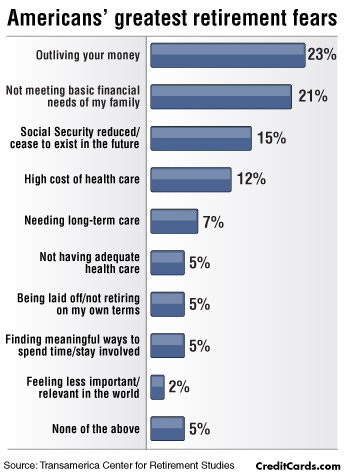

According to a recent survey, the most significant retirement fears (by a sizeable margin) relate to being able to cover your expenses once the paychecks stop flowing financially.

The summary of the survey is shown below:

To best address these fears, it is critical to understand various withdrawal strategies for creating your required retirement income from your portfolio.

Following are seven strategies you should consider to tilt the odds in your favor.

1. Maximize Your Savings

The focus of this article is on post-retirement income.

However, the first and most important strategy is to maximize how much you’ve saved before retirement.

If you’re running behind the plan, don’t retire until you have a sufficient investment portfolio to fund your retirement.

Once you’ve left the workforce, it’s tough to reverse course and find a position paying the income you were making before you retired.

Be patient if necessary, and start from the strongest possible base.

Save as much as you possibly can, and seek the counsel of a Certified Financial Planner to insure you’re ready to retire.

2. The 4% Rule

Don’t withdraw too much from your portfolio in any given year.

While the historical “rule of thumb” has been to limit your early retirement “paycheck” to 4% of your investment base, be cautious.

A better assumption to insure you outlast your money is to start at a 3% withdrawal rate if at all possible given today’s low-interest-rate environment.

For every $1 Million saved, you should only “pay yourself” $30,000 (3%) to $40,000 (4%) of post-retirement income.

For the sake of this article, we’ll assume your first year’s withdrawal will be in the middle range, at $35,000.

3. Adjust Your “Retirement Pay” Annually

Historically, the rule of thumb has been to start with your “Year 1” withdrawal rate and increase it by the rate of inflation.

For example, if your Year 1 was $35,000 and inflation was 3%, you could increase Year 2 to $36,050 ($35,000 X 1.03).

However, new studies on increasing the odds in your direction now favor a new approach:

- In A Bear Market – take a pay cut.

- In A Bull Market – give yourself an increase.

For my family’s retirement strategy, we intend to update our net worth annually. (See my article on net worth HERE, and my net worth statement template HERE).

Once I have my “new” net worth value, I’ll multiply that by a “safe” withdrawal rate (3.5% in our example) to determine the next year’s paycheck.

For example, if our $1 Million portfolio changes, we’d do something like this:

- Bear Market: $900k Paycheck reduces to $31,500 ($900k X 3.5%)

- Bull Market: $1.1 M Paycheck increases to $38,500 ($1.1 M x 3.5%)

In the unfortunate situation of a bear market and a pay cut, we’ll have to cut back our non-essential spending for a year to insure the long term outlook of our money lasting longer than we do.

It’s easier to make small annual adjustments than to realize at age 85 that you no longer have sufficient money to cover your base spending requirements.

4. Minimize The Tax Bite

The scope of tax strategy is beyond the scope of this article, but realize that how you withdrawal funds from various account structures can significantly affect your spending needs in retirement.

Since taxes must get funded by the same portfolio now providing your paycheck, any reduction in tax provides more funds for your living expenses.

In general, a retiree should look to spend after-tax money first, followed by IRA funds, leaving Roth money as the last payment gets withdrawn.

There is a vast amount of information on this topic, and anyone approaching or in retirement should spend the time to research and understand the subject.

Again, a Certified Financial Planner can offer this service if you’re unwilling to educate yourself.

Regardless of how you choose to manage it, manage it you must.

5. Optimize Social Security

Another topic too detailed to address in this summary, but optimizing your social security benefit is one of the most significant decisions you face as a retiree.

In general, the longer you can defer starting your withdrawals, the better (unless you have a health risk and fear an early death).

Social security benefits compound at an 8% annual growth rate, which is the best “no risk” return you can earn.

Study up on this carefully before beginning your benefits, and make every effort to delay your claiming to Age 70 if possible.

6. Fill Your Buckets: Maintain Equity Exposure, But With A Cash Cushion

Retirees are justifiably nervous of bear markets.

Regardless, it is vital to maintain an equity exposure to insure your portfolio continues to grow in retirement.

Your expenses will increase with inflation, and your portfolio must grow to fund this increased spending.

To balance this dilemma, build a “Bucket Strategy”, with your “First Bucket” filled with ~1-2 years of living expenses in cash.

Your “Second Bucket” should cover several additional years of spending needs and be filled with liquid fixed-income investments (CD’s, Bond Ladders).

Your “Third Bucket” is filled with higher return and higher risk investments, with a focus on equities.

In the event of a bear market, you avoid “selling” for several years, allowing equity prices to recover before you need access to the funds.

In a Bull market, sell equities at the higher values and refill your first two buckets.

The timeframe of Bucket One and Bucket Two can be adjusted to match your risk profile.

My wife and I are planning a conservative approach, with at least two years in Bucket One and an additional 3-5 years in Bucket 2.

7. Consider Annuities

Finally, don’t forget about annuities.

While these have gotten some bad press, the reality is that there are some very viable options available to meet some critical retirement needs.

In an annuity, you place a significant portion of money with an insurance company in return for a lifelong income stream through retirement.

I’m several years away from retirement but have been investigating annuities carefully as a guaranteed income option, though with lower returns (and less risk) than are typically available through equities.

In my situation, I will likely wait several years for interest rates to increase before allocating some capital into annuities, as the payout is directly correlated to interest rates.

Another approach is to allocate money into annuities over several years to avoid putting all of your money to work in today’s low-interest environment.

Regardless of the approach, I encourage you to evaluate annuities with an expert (I’m using Vanguard) as part of your retirement spending strategy.

Conclusion

By using all of the approaches above, you should be able to minimize your risk of outliving your money.

Retirement should be viewed as some of the best years of our lives, and anything we can do to reduce our worry should help us all in reaching The Retirement Manifesto’s objective of “Helping People Achieve A Great Retirement”!