When you think about it, not many investments you make are physical. If you invest in stock, all you have are numbers on a computer screen. It’s the same with a bond. This can get boring and tedious.

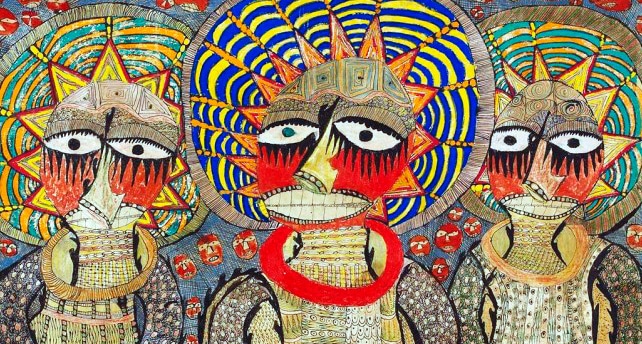

Art, however, represents something tangible. Something you can see on your own walls. Sometimes it’s even very pretty to look at. Because it’s an illiquid asset, you might not sell for a while. The upshot is that at least you get to admire its quality. Perhaps you could even have a go at interpreting it.

Expensive

The most expensive painting sold so far is The Card Players by French maverick Paul Cezanne, who painted it towards the end of the 19th century. The painting was sold by George Embiricos and made $274 million.

It’s a lot of money, but we’re not all going to get our hands on a Cezanne, or a Van Gogh, or a Picasso, and we’re not all going to make $274 million.

But this is where the fun comes in – discovering the next Picasso.

Scouting for Art

Charles Saatchi, globally renowned British business person and owner of Saatchi Gallery in London, UK, recognised more than most the value of discovering the next Picasso. He bought his first piece of art in 1969, establishing a collection that crammed with works that had huge potential, before going onto discovering now-famous artists such as Damien Hirst. Charles Saatchi made a fortune from investing in art.

And he doesn’t limit himself to high-priced art or big names. Instead, Saatchi spends thousands at graduate degree shows, hoping to discover the next big thing.

Because art, for him, is something to be enjoyed. But it’s also something that eventually bears lots of fruit from the money tree. Scouring the world for the next masterpiece, unlike stocks and bonds, can actually be pleasurable. You get to see what you’re investing in, and you get a real buzz.

The best thing is that a huge amount of awesome contemporary art is out there – just waiting for you to discover it! You could be the one who turns a young, undiscovered but brilliant artist into a star. How awesome does that sound?

Value

The ‘problem’ with investing in art is that a piece of art can have a long holding period. If you buy an artwork, it could be years before you get the chance to sell it for a big profit. Some investors are put-off because it’s an illiquid asset.

For some, this does represent a problem. Others – the more savvy among us – realise this isn’t a problem. Contemporary art represents a significant asset – and it’s an asset many of us can afford. Indeed, low-priced art can actually do better than high-priced art. Even better, the audience for art is growing and growing. People love contemporary art – and they’re prepared to pay for it.

Moreover, according to the Mei Moses Family of Fine Art Indexes, art rises at the same rate as stocks. If you invest in the right artwork, that painting of a bird that you can’t get your head around could actually outperform everything else in your portfolio.

So, if you’re looking to invest say, 10% of your investment portfolio in illiquid assets, you could do much worse than try the exciting world of contemporary art.