Industry 4.0 is a term created in Germany at the beginning of this decade to represent the 4th wave of society based on modern automation, Information and Computer Technologies (ICT) and new manufacturing technologies.

The previous waves were the Industrial Revolution which used water and steam power to drive industry, the wave of mass production, which radically changed the economics of production and the Digital Era of modern electronics and computing.

Industry 4.0 represents the impact on industry of ubiquitous computing, sensor technology and high-speed communications. It covers not only the exponential increase in computing power per unit cost but also the ability to collect vast amounts of data and process it in ways that were not previously feasible, either technically or economically.

Much is written about the consequences of Industry 4.0, including the threat of new business models and the impact on competitiveness and employment. This has tended to be focused on the Internet Service and Hi-Tech Sectors.

The paper is mainly for more traditional industries such as process chemicals, energy and mechanical engineering. It argues that Industry 4.0 will impact the development of any industry’s Core Competencies and Capabilities. It highlights the importance of predicting how and when any impacts will occur as an essential input to the development of a company’s strategy.

Previous research by the EIIL looked at the Digital Era and how it was changing the characteristics of the future workforce – the so-called ‘Connected Generation’ [1]. The research also highlighted how industries might design their management style and systems to exploit the different skillset of the Connected Generation. Finally, it also covered how service industries, such as travel, social networking and banking, were being transformed by highly networked, winner-takes-all “Internet Service Models”.

Although many managers could see how the service industries might be transformed by ICT, managers in traditional manufacturing were less likely to see Industry 4.0 as a clear and present challenge to their existing business models. Hence we developed a model to place Industry 4.0 in a clear context to assist traditional companies in assessing their business environment.

Core Competencies, Capabilities, Commoditisation

In 1990, the concept of Core Competencies and Capabilities was proposed by Prahalad and Hamel [2]. They said that a good strategy for companies is to actively identify and develop their strategically important ‘Core Competencies’ to outperform their competitors. Activities needed to run the business that was not strategically significant were termed ‘Capabilities’, and their development was less of a priority.

Core Competencies and Capabilities can slowly ‘commoditise’, intentionally or unintentionally. By this, we mean that, over time, know-how and business processes are transferred to other companies operating in the Business System. If other companies can master these capabilities at a lower cost, they replace ‘in-house’ capabilities (often referred to as ‘outsourcing’).

This lower cost can come from economies of scale, where the same service is supplied to many companies, or from a different cost base, for example, from lower labour costs. The overall benefit is that industry costs are lower, and the competitiveness of companies is improved.

This commodification of core competencies and capabilities is not a new phenomenon in many industries. Core Competencies and Capabilities change with the business environment.

For example, chemical companies developed polymer processing equipment as the plastics industry expanded in the 1970’s. It was seen a core activity to drive the growth of polymers but was eventually sold off into separate equipment suppliers as the technology became established.

Another example is the shipment by road of chemicals. This was, initially, done mainly by chemical companies to ensure safe and reliable supplies but was eventually outsourced as specialised logistics companies, having better economies of scale because they operated across industries, acquired the know-how.

More recently, chemical plant maintenance operations, once seen as ‘core’ to an efficient chemical plant operation, are now outsourced to engineering service companies. On large chemical sites with many operating companies, it is unlikely that each operating company can afford to maintain the size and quality of manpower to cope with all its maintenance needs.

Such companies transfer know-how on their chemical processes and equipment to Engineering Service Companies that cover a great site. They can maintain a pool of manpower which is optimised to cope with peak demands such as plant overhauls or unforeseen maintenance events. They can retain specialist expertise covering all types of equipment.

Commoditisation versus Codification

Many industries have managed, for better or worse, their core competencies and capabilities. This includes aspects of technology which have been grouped into Industry 4.0, such as computer power, sensor technology and networking.

For example, industries already use computer technology to enhance and develop their Core Competencies and Capabilities. They have introduced computer systems into their business over decades for factory control and business process management. Tasks that required professional judgement have been enhanced through the automated collection of data and its analysis.

It is understandable that they may see Industry 4.0 as a simple continuation of this trend. However, this ‘business as usual’ approach is likely to be complacent. The commoditisation of core competencies and capabilities is likely to change significantly due to the trends recognised as leading to Industry 4.0.

The relatively slow process of commoditisation will evolve into a far more rapid means of ‘codification’ of Core Competencies and Capabilities. By this, we mean that computer algorithms will be developed, which will replace professional judgements at vastly reduced cost and increased reliability compared to today’s approach using trained professionals.

Another feature of codification is that once developed, the algorithm can be used at little marginal cost, and the owner of the algorithm can quickly deploy it and dominate a market.

As highlighted in [2], this winner-takes-all characteristic encourages companies to develop their products quickly because it is imperative to be the first to succeed and capture the benefit of any network effects. Here we draw an analogy with the Digital Era and the dominance of Google, Facebook, LinkedIn and Paypal. There is not much room in the market for algorithms that come second.

The 5C Model

What does this mean for traditional industries? We consider first, the pre-Industry 4.0 case. Mainly, the commoditisation of core competencies and capabilities can be regarded as an uncertain and disruptive change to a company’s business environment.

The rate of commoditisation is quite slow as it depends on know-how and business processes’ leaking’ into the Business Systems company by company.

An appropriate response to analysing uncertain events is to develop potential scenarios during the environmental scan of a strategy process.

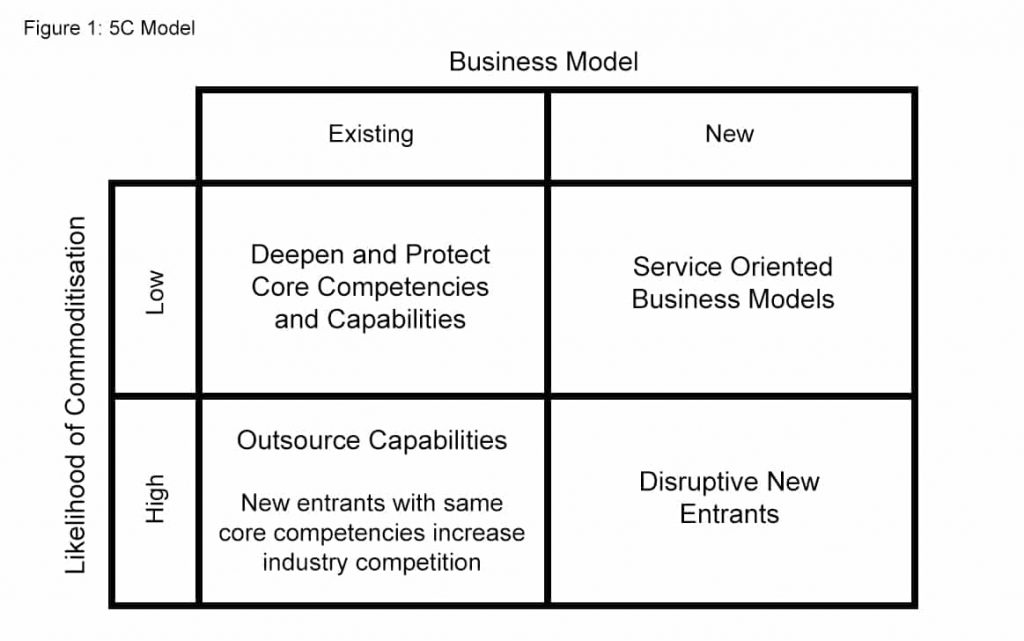

One way of approaching this is to develop a 2×2 matrix based on (a) the likelihood of core competencies or capabilities commoditising and (b) whether new business models can emerge (the 5C Model in Figure 1).

In our investigations, this leads to 4 generic scenarios.

Existing Business Models/Low Likelihood of Commoditisation

1. Where there is no likely change in business model and where the likelihood of commoditisation is low, a company should act to develop its core competencies and capabilities to ensure it remains competitive. This is ‘business as usual’. An example of this is the outsourcing of business processes such as production scheduling, order handling and raw material purchasing to Enterprise Resource Planning (ERP) software.

Existing Business Models/High Likelihood of Commoditisation

2. However, if a capability is likely to be commoditised, the company should seek to outsource it to retain its overall competitiveness. Examples of this are the outsourcing of maintenance of company PC’s and IT systems, catering and site security. If a core competence is subject to commoditisation new entrants will be drawn into the market. An example of a core competency being outsourced will be if production technology is licensed, allowing new competitors into the market.

New Business Models/Low Likelihood of Commoditisation

3. If a new business model is plausible and the core competencies and capabilities are unlikely to be commoditised, companies can consider using the core competencies to develop new service for their customers based on, for example, technical support or other services that improve their customer’s profitability. An example would be managing customer’s raw materials stock levels by providing storage tanks and an automated refilling service. Another example would be the use of specialist knowledge about a material that is supplied to design parts that the customer will make.

New Business Models/High Likelihood of Commoditisation

4. If however, core competencies and capabilities are likely to commoditise and a new business model is possible, then completely new entrants can enter the market in unexpected ways, radically changing the industry. A classic example of this is the standardisation of computer components that allowed the personal computer to be invented and overwhelm the market for mainframe computing. A more recent example would be the replacement of travel agencies with on-line internet booking sites and apps.

A characteristic of this process of commoditisation is that similar resources, whether they be human or fixed assets, are typically being deployed but more efficiently. Also, the timescale required for commoditisation is quite long as there is a need to build assets and develop a workforce.

Industry 4.0 and the 5C Model

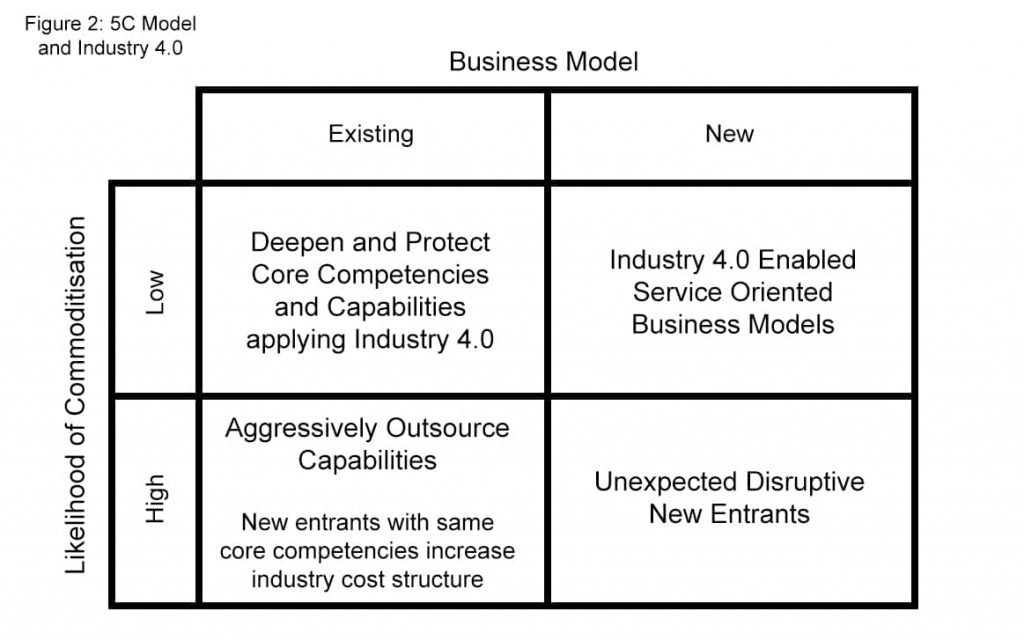

How does this change if we introduce the impact of Industry 4.0? Primarily, the process of commodification of core competencies and capabilities is based on codification and automation.

The economics of competition and the timescale with which it can be implemented can be radically changed. Codification and automation mean that additional specialists and professionals no longer need to be created, and the marginal costs of operating can be drastically reduced.

Industry 4.0, therefore, potentially implies a highly uncertain and disruptive change to a company’s business environment.

There will be three likely consequences of this.

Firstly, the rate at which existing core competencies and capabilities can be developed and commoditised may accelerate. Codification is increasingly likely to happen, and when it does, it can be replicated more quickly. The speed of this process is unpredictable but will create new sources of competitive advantage.

Secondly, the ability to acquire and analyse data may become a new core competency that will have the power to adapt business models in an industry.

Finally, the power to codify may attract new entrants into the industries with totally unique business models. The potential scenarios are now slightly different from before, as they must include the new possibilities of an Industry 4.0 world (Figure 2).

Existing Business Models/Low Likelihood of Codification

1. If there is no likely change to the business model and core competencies and capabilities are not likely to be codified then the rapidly developing technologies, which are part of Industry 4.0, will still have to be applied to build core competencies and capabilities. In this way, a company has a chance to maintain its competitiveness in the market.

Existing Business Models/High Likelihood of Codification

2. If capabilities are subject to codification, companies will need to be more aggressive in outsourcing these capabilities in order to maintain competitiveness. If core competencies can be codified, new entrants will arrive more quickly and with radically different cost bases due to automation. An example of this will probably be quite rare as codification would drive an existing business model into the Cloud.

New Business Models/Low Likelihood of Codification

3. If core competencies and capabilities are unlikely to be codified, then possibilities will exist to apply these skills to the new source of data collection and analysis in Industry 4.0. Selling services based on this could form the core of new business models.

New Business Models/High Likelihood of Codification

4. If core competencies can be codified and used in new business models, then new entrants into the market will be able to spring up unexpectedly and establish themselves at a surprising speed.

Reducing it to practice – illustrative examples from an Industry 4.0 Scenario

In testing this model, we looked for examples of companies analysing the impact of Industry 4.0 on their activities. To illustrate each generic scenario, below is a compilation of cases that we found.

Low Risk of Codification / Existing Business Model

This is probably the most commonly quoted scenario to the point where it can be regarded as Business As Usual. Several examples exist of companies trying to develop their Core Competencies and Capabilities by applying advances in computing and networks (Cyber-Physical capabilities). Examples include adding sensors to their products to monitor their performance or provide better control, sometimes allowing the monitoring to be done remotely. Another example is the use of advanced software to model complex chemical processes which enhances the productivity of experienced professionals or software, which helps optimise the design of mechanical equipment.

High Risk of Codification / Existing Business Model

There are many examples of companies outsourcing capabilities, as Industry 4.0 drives the codification of business processes.

One example is the outsourcing of Human Resource Business Processes to cloud-based service companies such as Workday and Oracle’s Peoplesoft. This effectively automates the work performed by Human Resource Departments and reduces fixed costs.

A more technical area is one of compliance documentation for chemical shipments. Previously, it was an essential capability to keep track of every countries’ chemical regulations so that shipments complied with complicated and overlapping regulations. This can now be outsourced to specialised companies. The internet-based service can be integrated into a chemical companies order and shipping systems to ensure compliance for each delivery. As a result, chemical companies can reduce the size of their specialised compliance teams.

Examples involving codification of core competencies are likely to be rare (as they would probably imply a change in business model). However, an engineering design company that could codify its operations could significantly improve its cost base while maintaining its business model and pricing. (However, if the software became publicly available or rival software emerged, it would imply a radical de-manning of the industry as is, perhaps, already being forecast [3].)

Low risk of Codification / New Business Model

There are many examples that apply to this scenario.

The first relates to the supply of seed to the agricultural industry. It is probably not likely that the technology behind seed production will commoditise or be codified. A seed company could use new technologies to improve its core competencies in a Business as Usual scenario.

However, there is also the possibility to use the vast amount of data covering climate, soil composition and pest life cycles. That data, in combination with the seed company’s know-how, could be used to improve yields. Seed companies must decide if they will simply supply seed or develop Industry 4.0 competencies and sell services to the agricultural industry. In these services, they would aim to help farmers increase their yield by advising on planting, watering, spraying with pesticides and harvesting.

The second example comes from Process Industries. Oil and gas companies have already outsourced the maintenance of their assets to specialised companies on a cost-plus basis. The engineering risk is born by the Oil and Gas Company. As sensors improve the condition monitoring of equipment, a new business model can emerge where Maintenance Service Companies price their service on plant availability. This moves the engineering risk off the Oil and Gas Company.

A third example would be a company that sells lights to public authorities for street lighting. Rather than sell light bulbs, it could contract to guarantee the provision of lighting to the community, use advanced sensors to reduce operating costs and divide the benefits with the public authority. This might be especially attractive as a business model if technology increased the life of the lighting system – effectively reducing the straight sales of the lighting system.

High Risk of Codification / New Business Model

Probably the most significant example of this case is the development of self-driving cars (as viewed by car manufacturers).

The technology in cars has slowly commoditised to the point where, to most people, cars are quite similar. Also, the enjoyment of driving is being diluted. Safety concerns, for example, fitting cruise and distance controls, street sign recognition and driver over-ride have deskilled driving. At the same time, there is an increasing demand for connectivity and entertainment in the car. Add on to this the rise in urban populations subjected to poor air quality, and there is a potential change in the nature of this market.

Google has amassed a store of geographical information in the form of Google Maps and StreetView and has used Industry 4.0 to develop the technology for self-driving cars which can be connected to their Internet Services.

Few car manufacturers foresaw or believed that Google would be able to codify the driving process and enter this market. However, it is likely that car manufacturers will lose control of their customers if Google introduces the self-driving car. They will become suppliers to Google. Even if car manufacturers can develop self-driving technology, the fact that Google can control advanced mapping technology and can supply entertainment into its own self-driving cars means it is likely it will have a strong competitive advantage.

Further thoughts

One area that is not covered in these generic scenarios is the possibility that previously outsourced capabilities should be reassessed for their importance and brought back into a company. Examples of this might be the recruitment of specialised staff to build new core competencies, or site services to create a new corporate environment or specialised technical areas where any new intellectual property may be protected.

Conclusion

Industry 4.0 represents a disruptive influence on all companies.

Apart from the technical possibilities enabled by Industry 4.0, the essential business consideration is its impact on companies’ Core Competencies and Capabilities. To that end, we present a simple model (based on the 5c’s of core competence, capability, commoditisation and codification) to help industries understand the impact of Industry 4.0.

It takes into account how Industry 4.0 will accelerate the rate of change that industries are subject to and that there may be new sources of competitive advantage that emerge.

Examples, based on four generic scenarios, illustrate the use of the model to build scenarios as part of an environment scan in a strategy process.

References

1. ‘The Impact of Information and Communication Technologies on Graduate Recruitment and Inter-generational Leadership – A Grounded Theory’, D A Hicks, S Price, EIIL Working Paper, 2015.

2. ‘The Core Competence of the Corporation’, C K Prahalad and G Hamel, Harvard Business Review, May-June 1990

3. ‘The Future of Employment: How susceptible are jobs to computerisation?’ C B Frey and M A Osbourne, Sept 17, 2013, Oxford Martin School University of Oxford

About the authors

Denis Hicks specialises in Coaching Innovation, Strategy, Industrial Marketing and Multi-functional/Multi-cultural Team working. He has a Master’s Degree in Engineering from Imperial College, London. Denis held senior roles in the Chemical Industry covering Production, Innovation, Business Development and Commercial Management globally including, most recently in Asia. He has over 20 conference publications. He holds several posts including Director at High Delta Limited, Advisory Director, EIIL, and has served as an External Expert for the European Union and the UNECE. He can be contacted at [email protected].

Steve Price is Executive Director of the European Institute for Industrial Leadership. He specialises in coaching high potential technologists towards senior management positions in the chemicals, process and energy industries. Steve is an engineer by profession and until 2001 had 18 years experience in the Chemical Industry, initially in manufacturing and operations roles, project management, and senior functional (IT) management. In 2003 Steve became Executive Director of the EIIL, where he developed its workshop programme and unique ‘Masterclass’ interview-based learning style. He has led EIIL’s ‘Leaders of Industry’ research activities for the last ten years which have produced reports, amongst others, on ‘The Shortage of Engineers in Europe’, as a result of which he appeared as an expert witness to the EESCs Consultative Commission for Industrial Change (CCMI). Steve can be contacted at [email protected].