Saving money for the future and emergencies is vital, but this is something that not everyone finds easy to do.

This idea is real, especially if you don’t have your place yet, and there are a lot of other bills to pay.

While it may not be that easy at first, there are ways on how to set aside cash even when you’re still renting your space, and there are a lot of bills to pay.

It may take hard work and discipline, but if you faithfully follow these methods by heart, you can achieve the goal of saving money, while paying your monthly bills, loans, and rent every month.

One of the essential steps for you is to analyse your present spending habit.

List your typical expenses and determine which of them you can eliminate.

For instance, cancel your magazine subscriptions if you don’t read or use the magazines.

Many people had long time subscriptions that they no longer need, but forget to cancel.

No matter how low the costs of these subscriptions are, they can get transformed into savings, and they will add up in the long run.

If you have a gym membership, but you don’t work out regularly, consider cancelling your membership and paying per visit, or try exercising at home following workout videos.

Check your cable, Internet, and phone subscriptions too.

Determine if they still meet your needs and make some adjustments or cancel if no longer needed.

If you still need them, ask if there are lower rates that might be a good fit for you.

Check with other providers too, and compare as they may have more affordable deals.

You may have a busy lifestyle that’s why like most employees, you might find it more convenient to dine out or order from restaurants or fast foods.

However, you can save more if you prepare your food.

The difference can be as high as 50% on your food expenses! Plus, you can also choose and prepare healthier meals, which is good for your body.

Work on your schedule so you can set aside at least one day a week to do your grocery shopping.

Plan your meals and list down everything you will need for that week.

There are a lot of easy to prepare meals that you can try, which will not take much of your time.

Consider those that you can prepare in batch and store in the fridge for more convenience.

This preparation will cut a considerable percentage of your expenses.

Another item on your monthly expenses is your transportation.

The cost of the gasoline is getting higher, and this means that if you continue to use your car, your budget for this specific area will also go up.

Consider walking, cycling, or using public transportation to save money. This form of travel is also a fantastic way to help in protecting the environment as this lessens pollution.

If you have office-mates, who take the same route as you do, how about organising a carpool? Take turns on who will drive for specific days or divide the gasoline expenses with the driver or car owner.

If you can do your tasks at home, ask your boss if you can spend some days of the week working from home.

Make sure that you still complete your assignments even when you’re not working in the office.

Some people are compulsive buyers.

They purchase items hastily without really thinking about it.

Most often, they end up realising that they spent money on things that they don’t need.

If you feel that you are one of them, it’s time to make the change if you badly want to save money.

Determine the things that you need to get and stick on that list.

This method or prioritisation doesn’t mean that you can’t purchase things that you want.

Either set aside a specific amount that you can spend for rewarding yourself or if the item that you like is a bit expensive, set aside an amount each payout, apart from your regular savings, so you can buy it.

It’s crucial that you still reward yourself so you wouldn’t feel deprived and it will be easier to stick with your new budget.

These are just some of the things that you can do to save money even while you are still paying bills, loans, and rent.

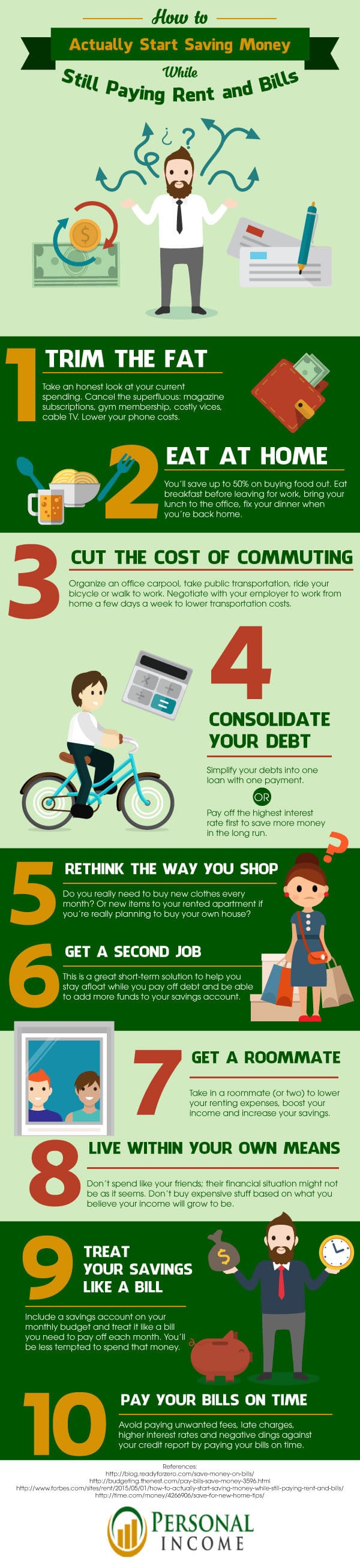

We want to help you save for the future that’s why we prepared an infographic that contains more tips on how to do this.

See our related and highly informative graphics below and start saving some cash:

(Source: Personal Income)